- Newsletter engine examples

- Posts

- New Post

New Post

Index

Administrative Update

Starting February 2, Augur Digest will transition to require a paid subscription.

As a thank you to our loyal readers, we will send out a special link with discounted pricing later this month.

Energy

1. The US launched an unprecedented military operation against Venezuela, capturing Nicolás Maduro and flying him out of the country.

Source: CNBC

Source: Financial Times

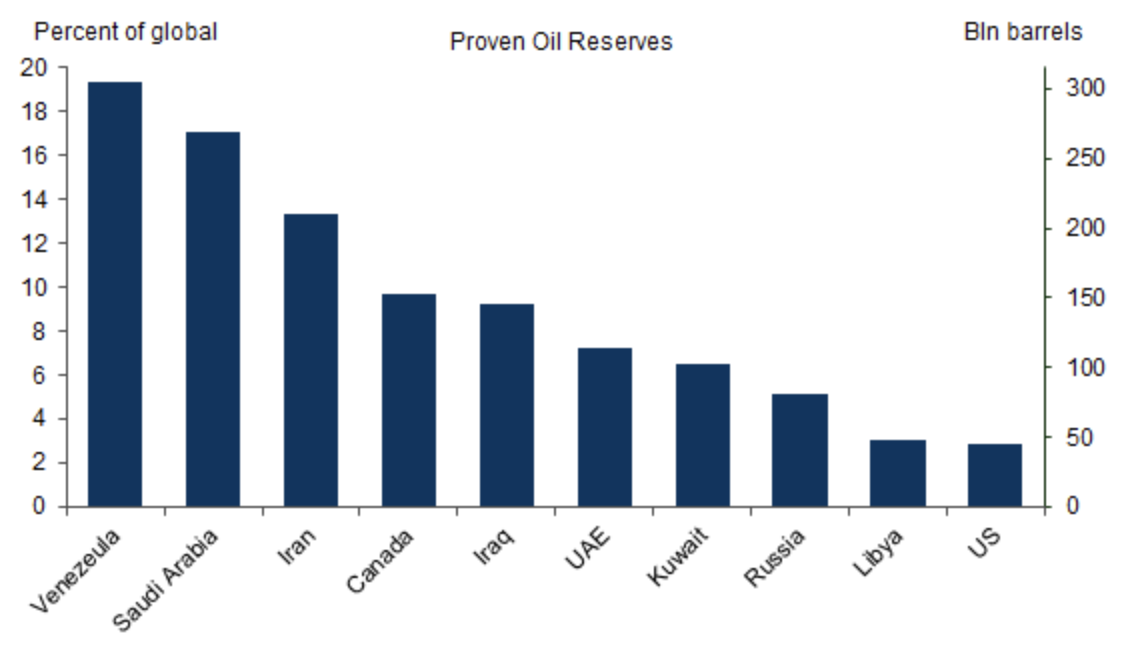

2. Venezuela holds nearly one-fifth of the global proven oil reserves.

Source: Goldman Sachs

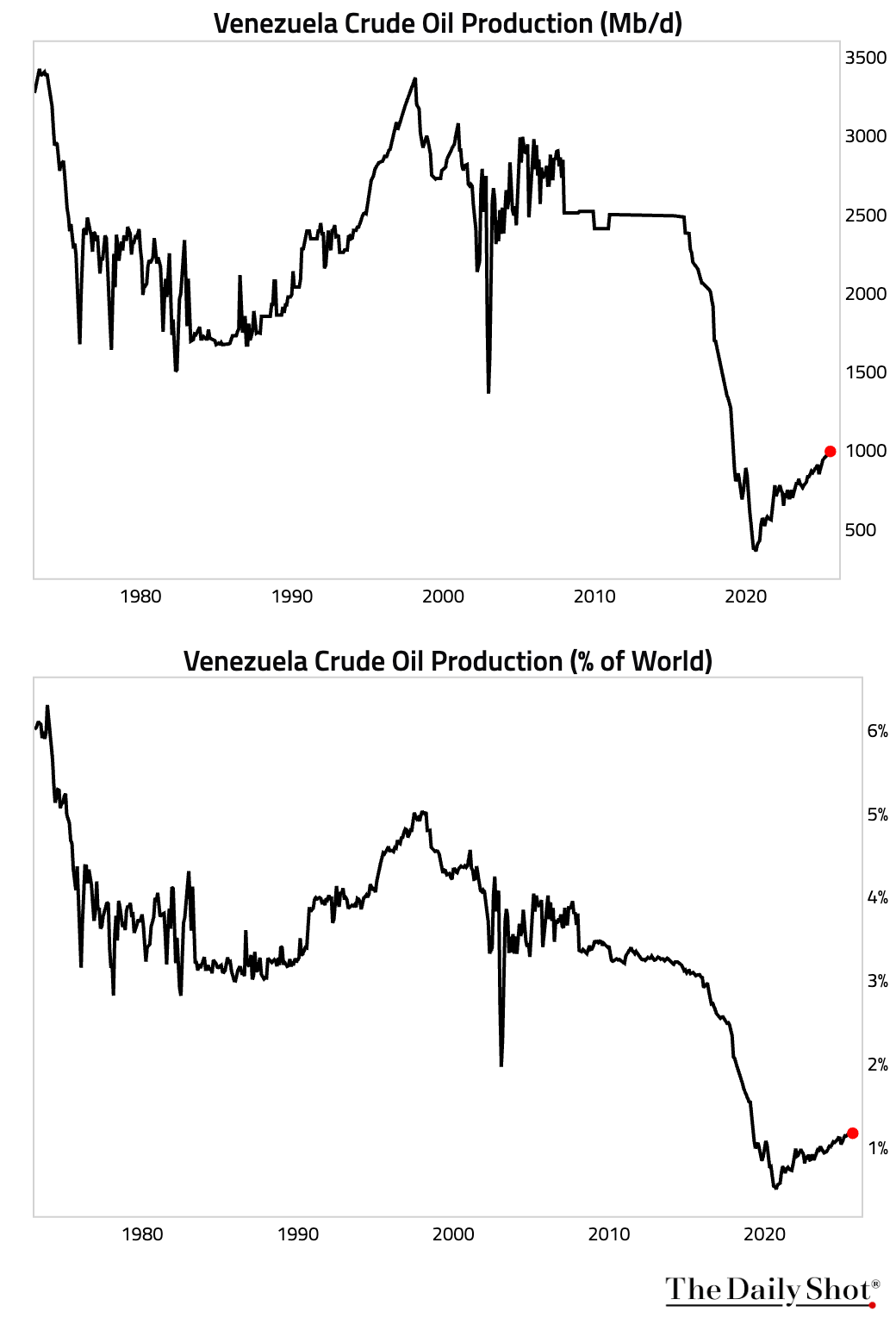

– These charts show Venezuela’s oil production over time.

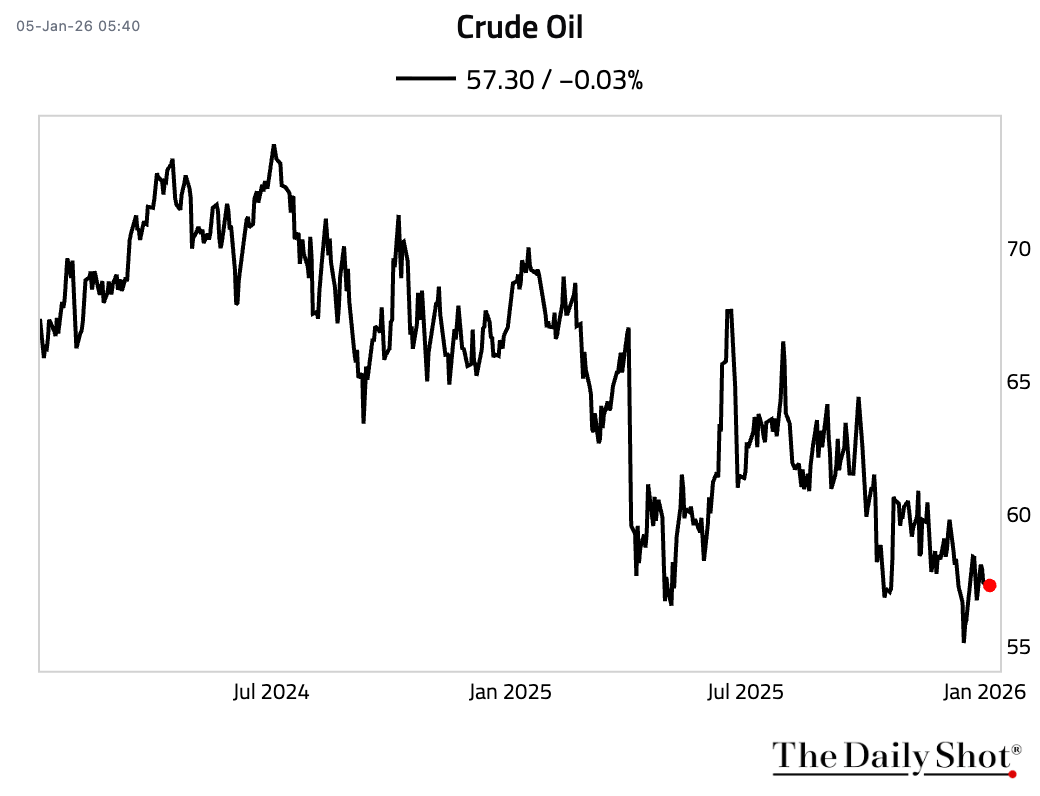

3. Crude prices edged higher as markets judged the capture of Maduro unlikely to disrupt global supply.

United States

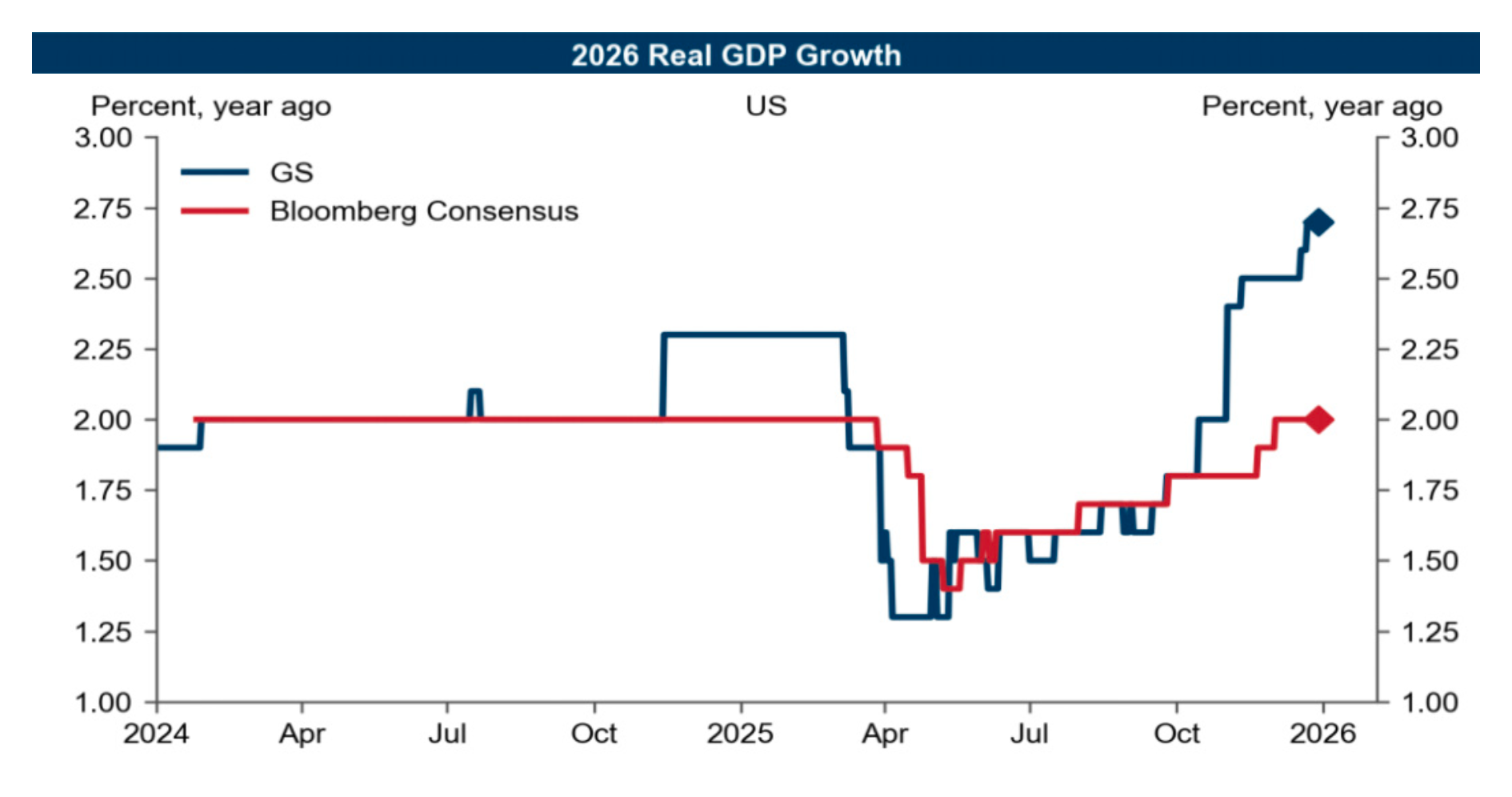

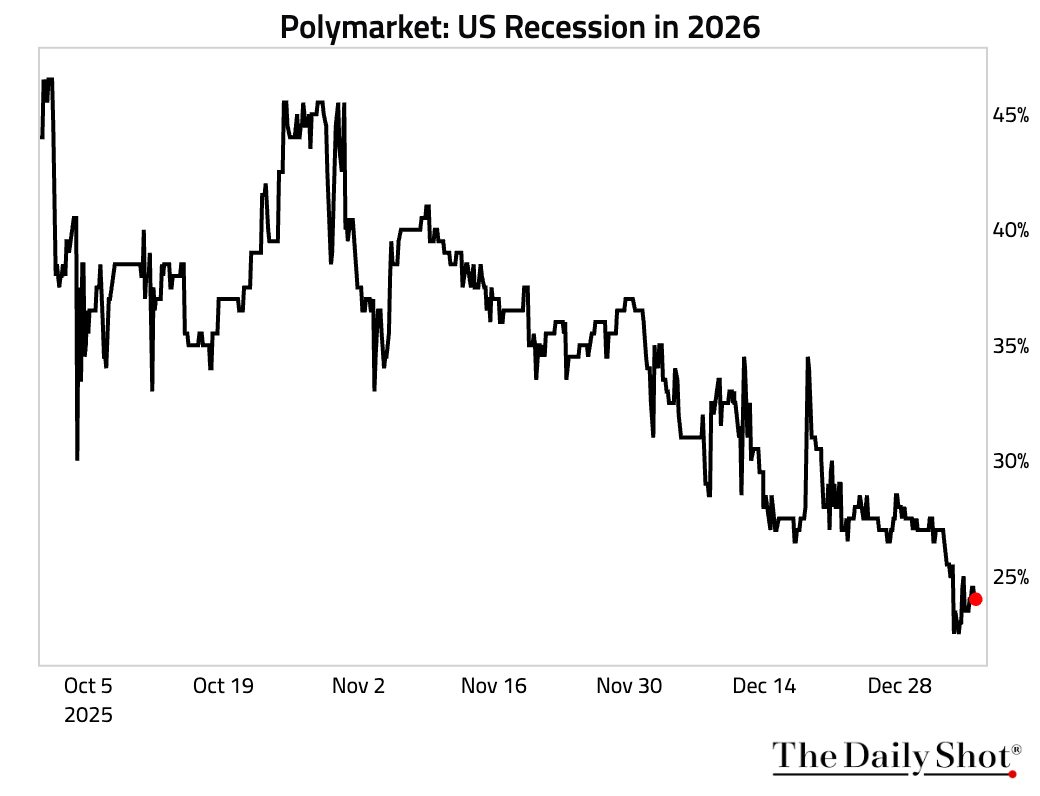

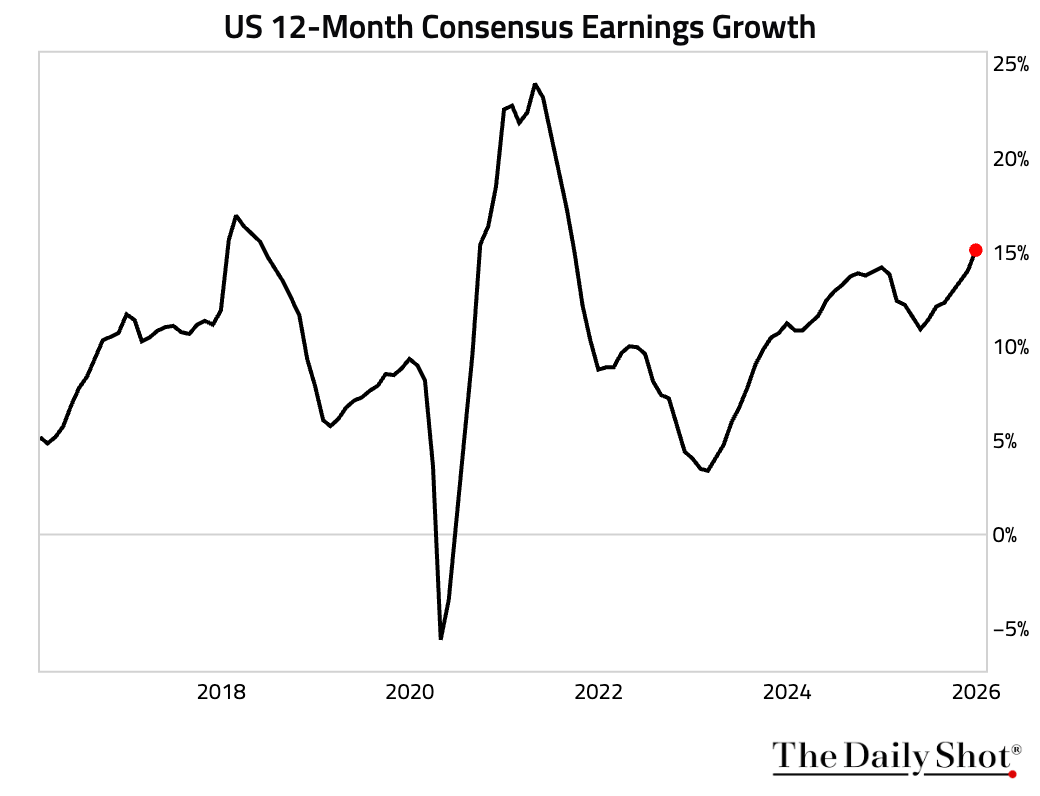

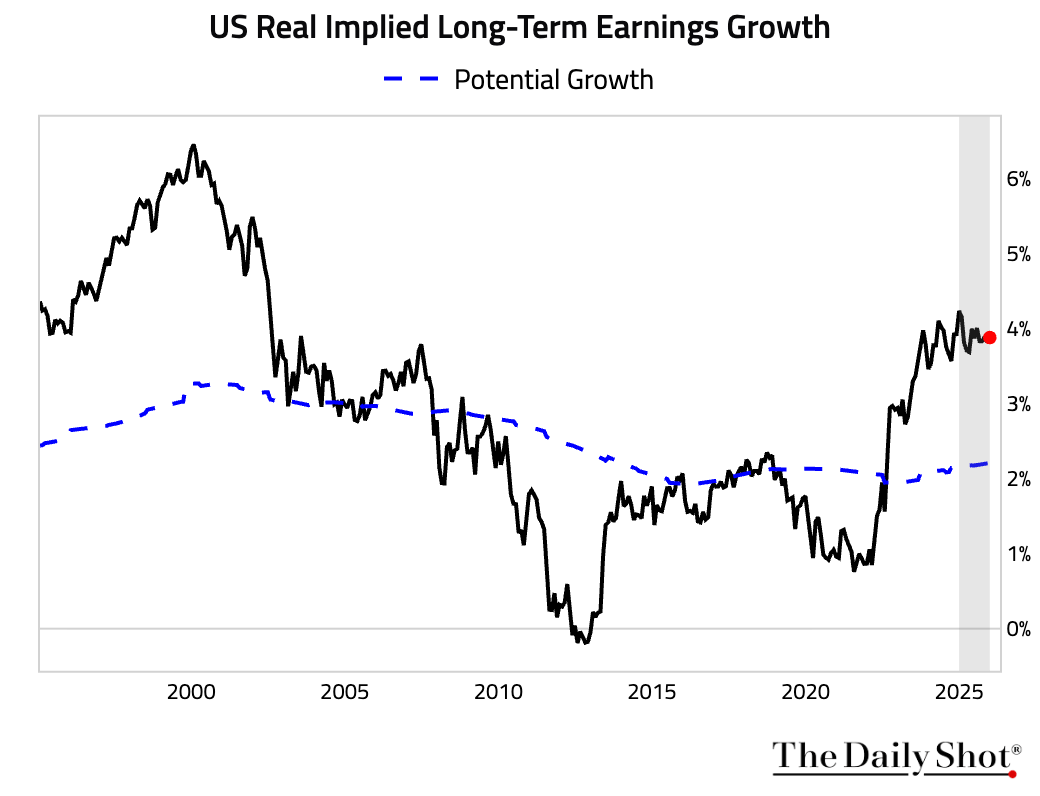

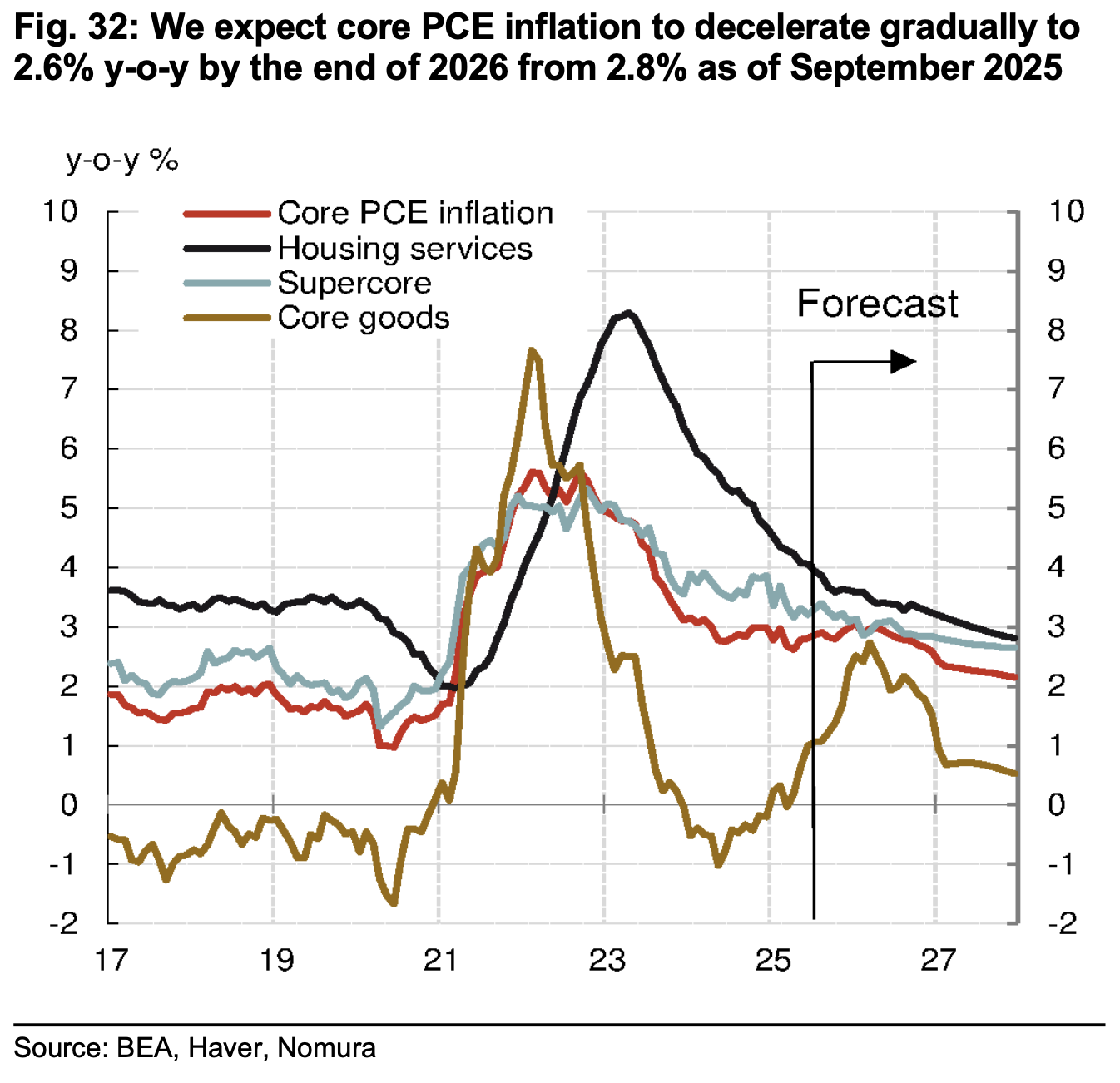

1. Analyst forecasts and market pricing for 2026 remain optimistic.

– Economists forecast solid US growth.

– Recession probability has declined to under 25%.

– Earnings growth expectations are the highest since 2021.

– Long-term growth pricing remains elevated.

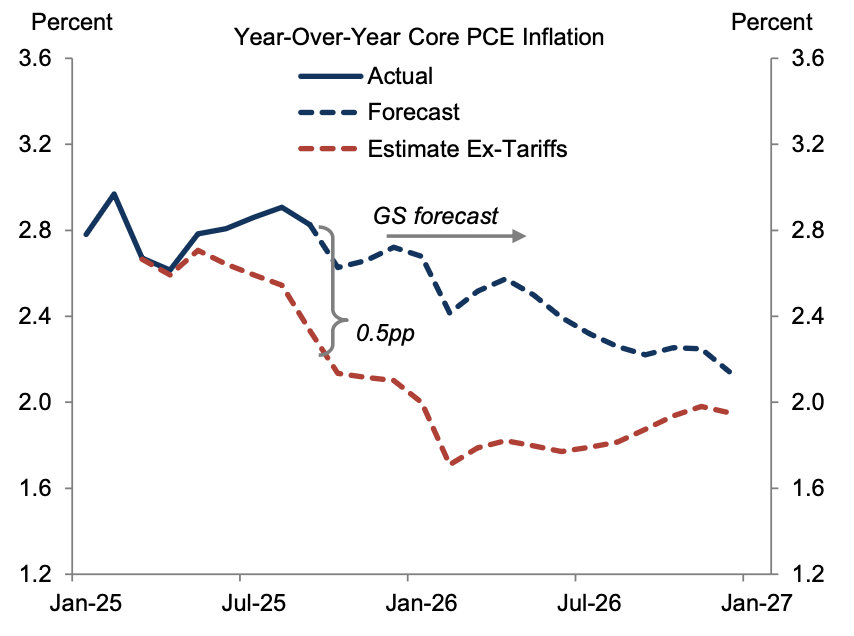

– Inflation expected to cool gradually.

… while Goldman forecasts much more progress, with a year-end core PCE forecast of 2.1%.

– The fixings market is pricing for December 2026 year-over-year CPI inflation to come in at 2.7%.

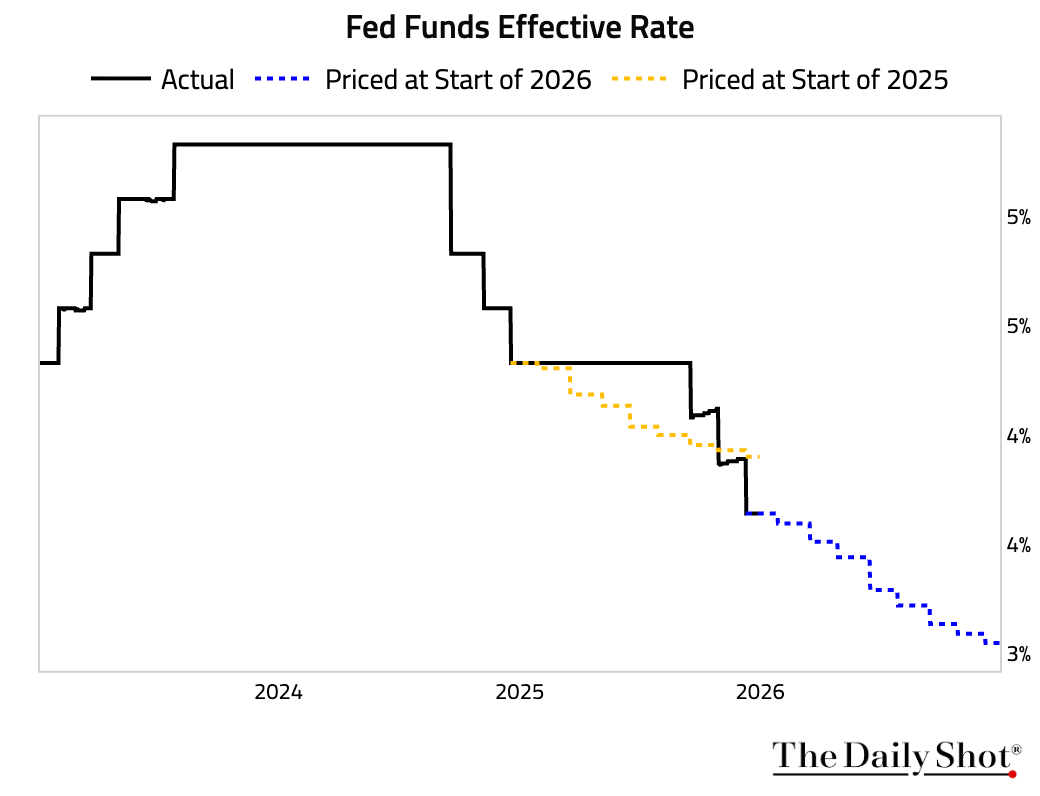

• Rates markets are pricing in about 60 bps of easing from the Fed in 2026.

• Rates markets are pricing in about 60 bps of easing from the Fed in 2026.

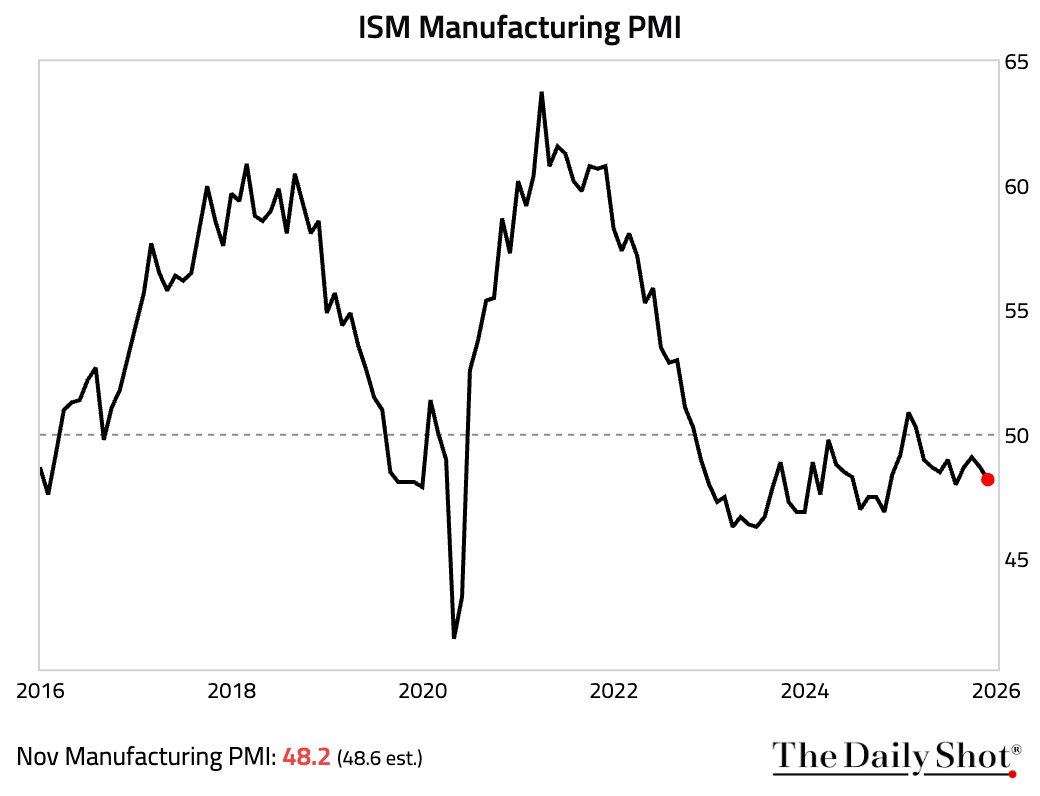

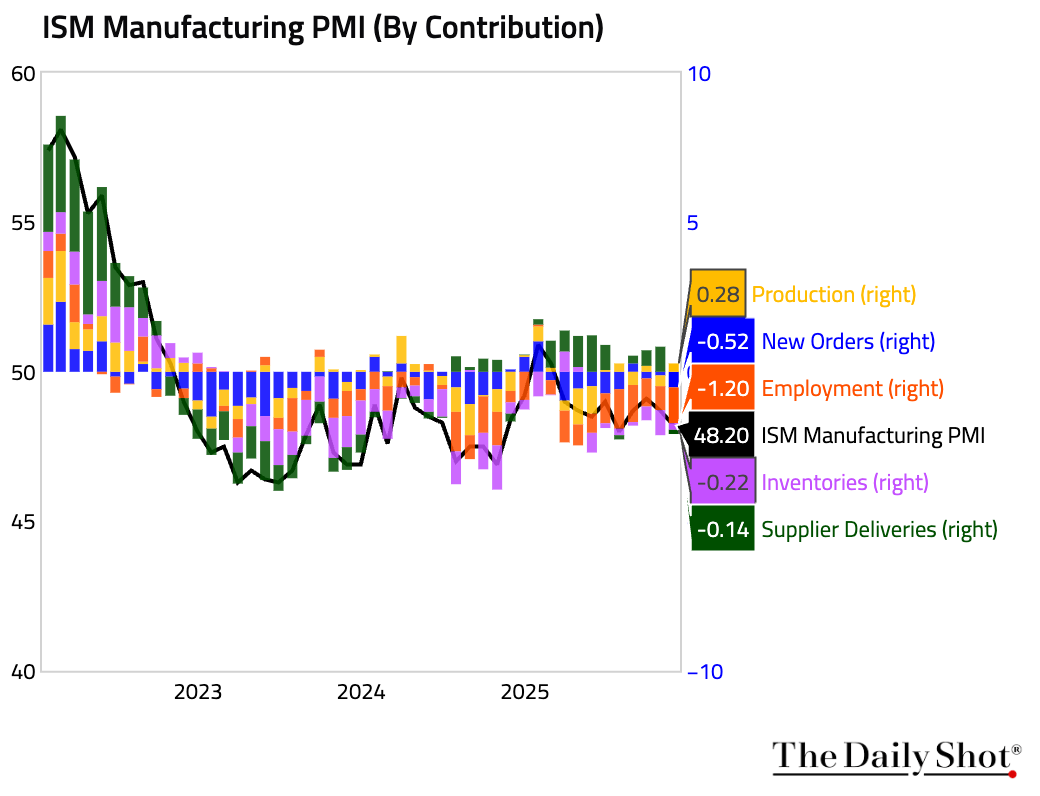

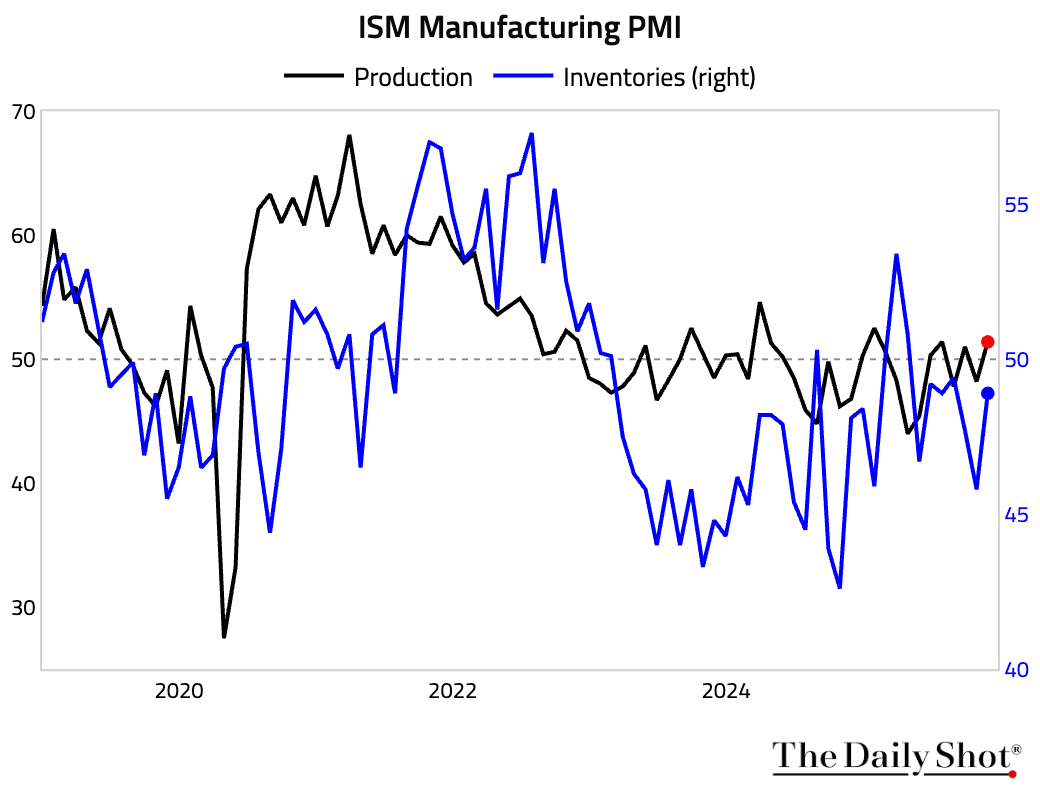

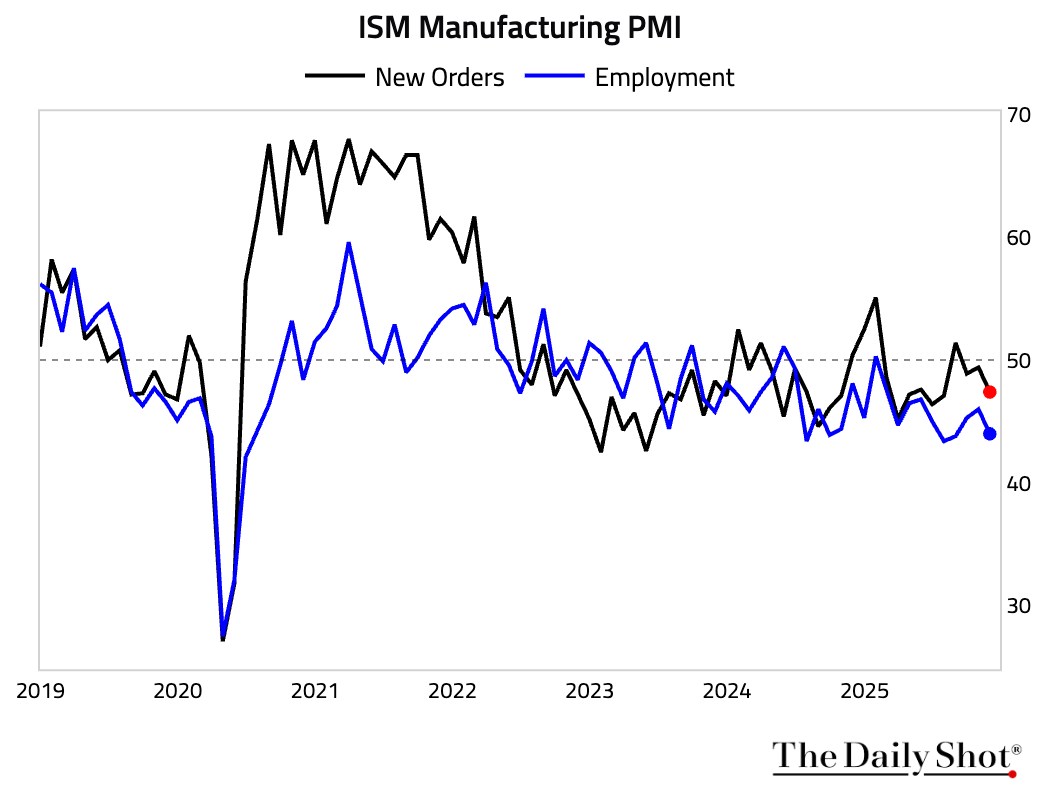

2. ISM Manufacturing PMI unexpectedly fell further into contraction.

This chart shows the contributions to the index.

• The underlying details fared better than the headline index suggests, as the weakness was driven by a sharp decline in the inventories sub-index. Production also edged down but remained in expansion.

• Both new orders and employment ticked up.

• The spread between new orders and inventories signals potential improvement ahead.

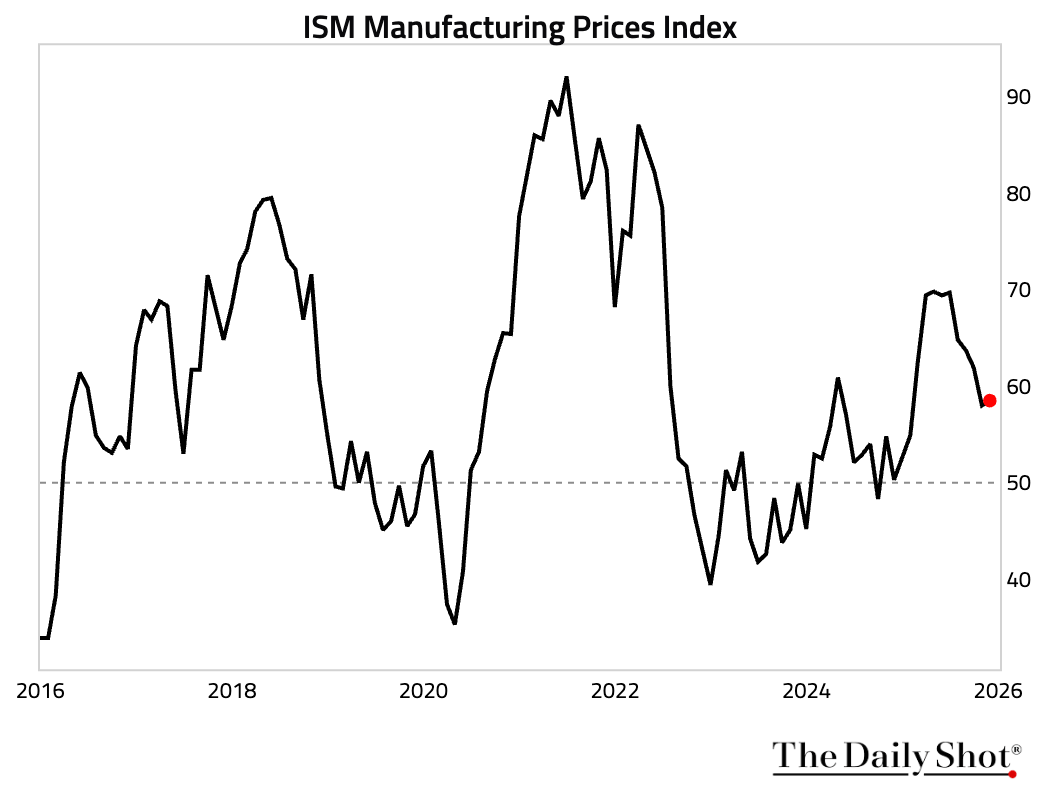

• The prices index held steady.

United Kingdom

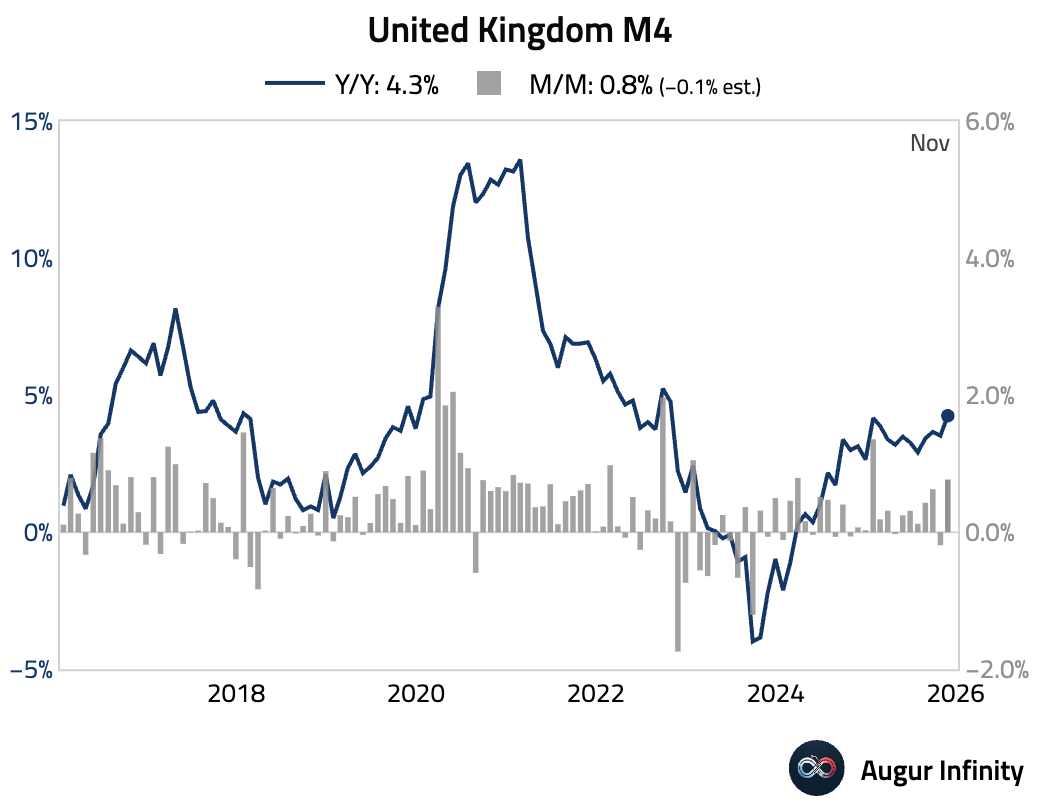

1. The M4 money supply grew in November, driven by a surge in households’ liquid assets, which posted their largest increase since October 2024.

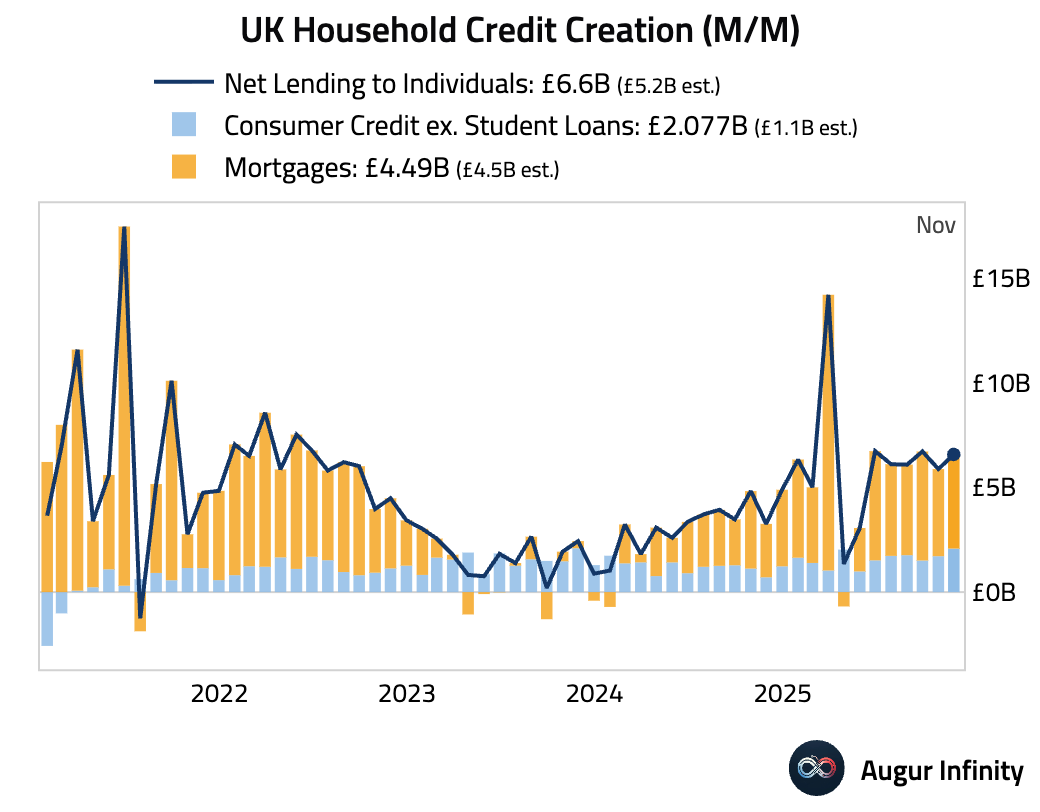

2. Household credit creation was stronger than expected in November, driven by consumer credit.

3. Mortgage approvals remained resilient in November, suggesting the housing market is holding up better than more pessimistic sentiment surveys had indicated.

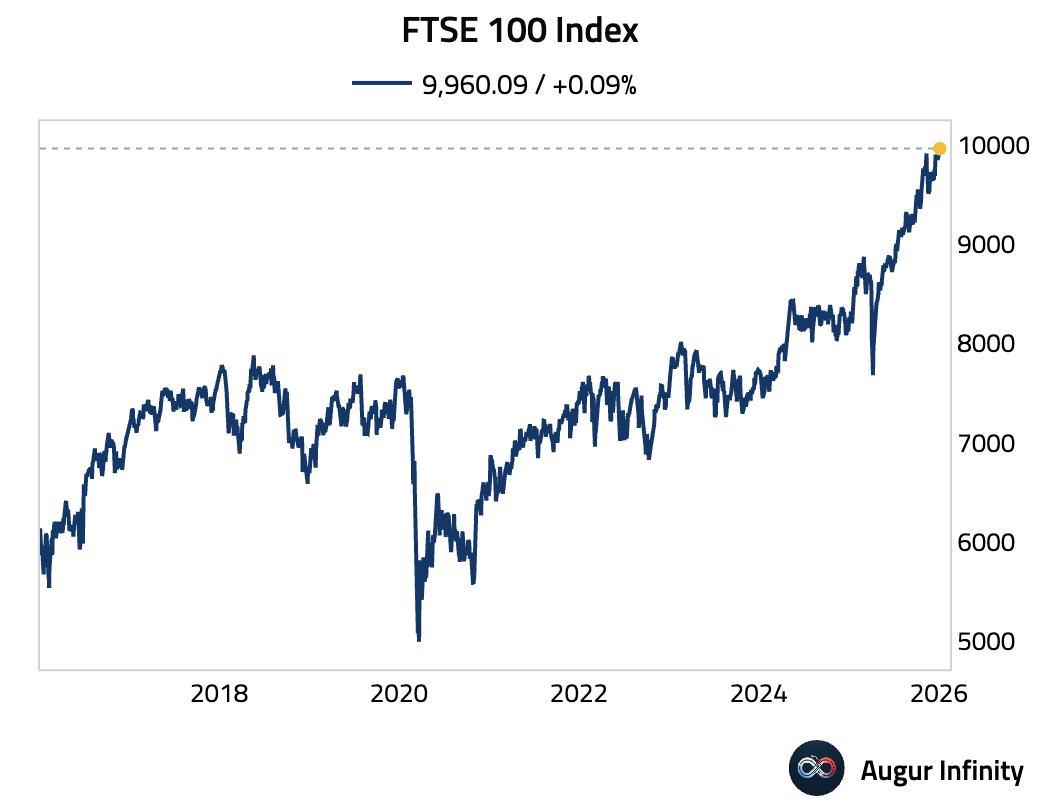

4. The FTSE 100 Index closed at an all-time high.

The Eurozone

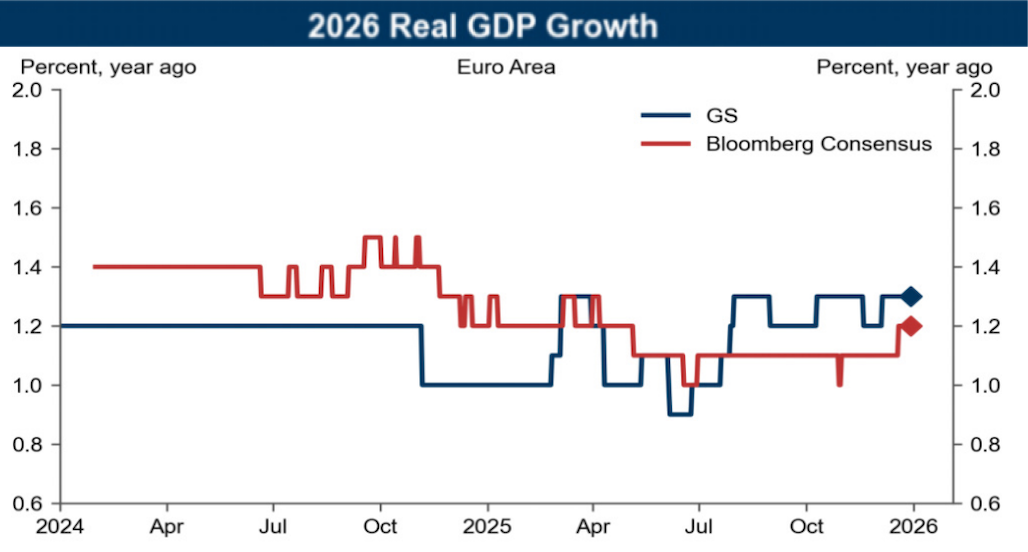

1. Here are the consensus and Goldman Sachs forecasts for euro area GDP growth in 2026.

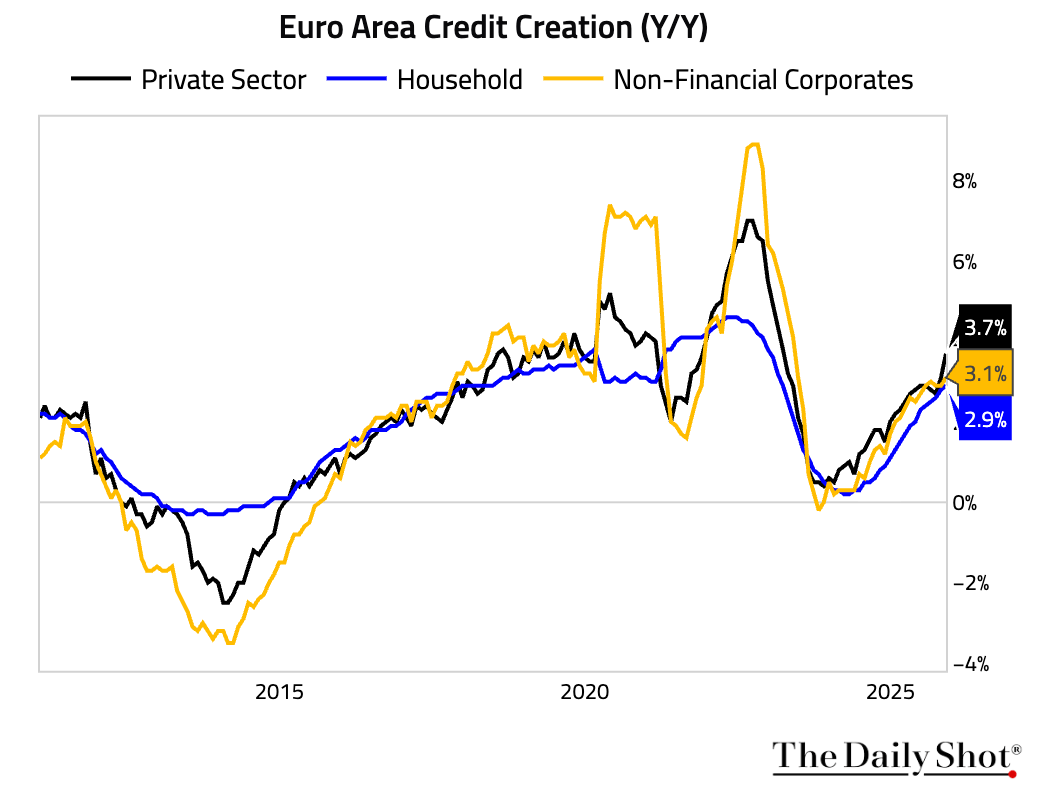

2. Private-sector lending continued to firm, with both household and non-financial corporate credit creation accelerating.

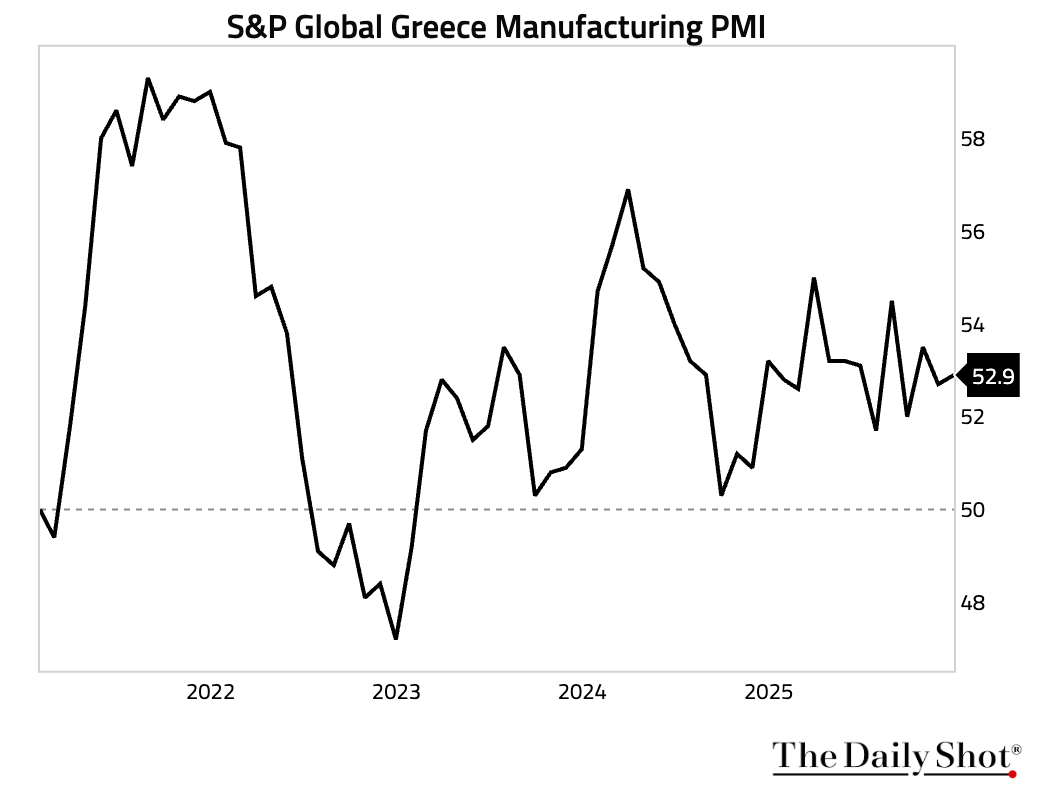

3. Greece’s manufacturing PMI rose as improving demand led to faster growth in new orders.

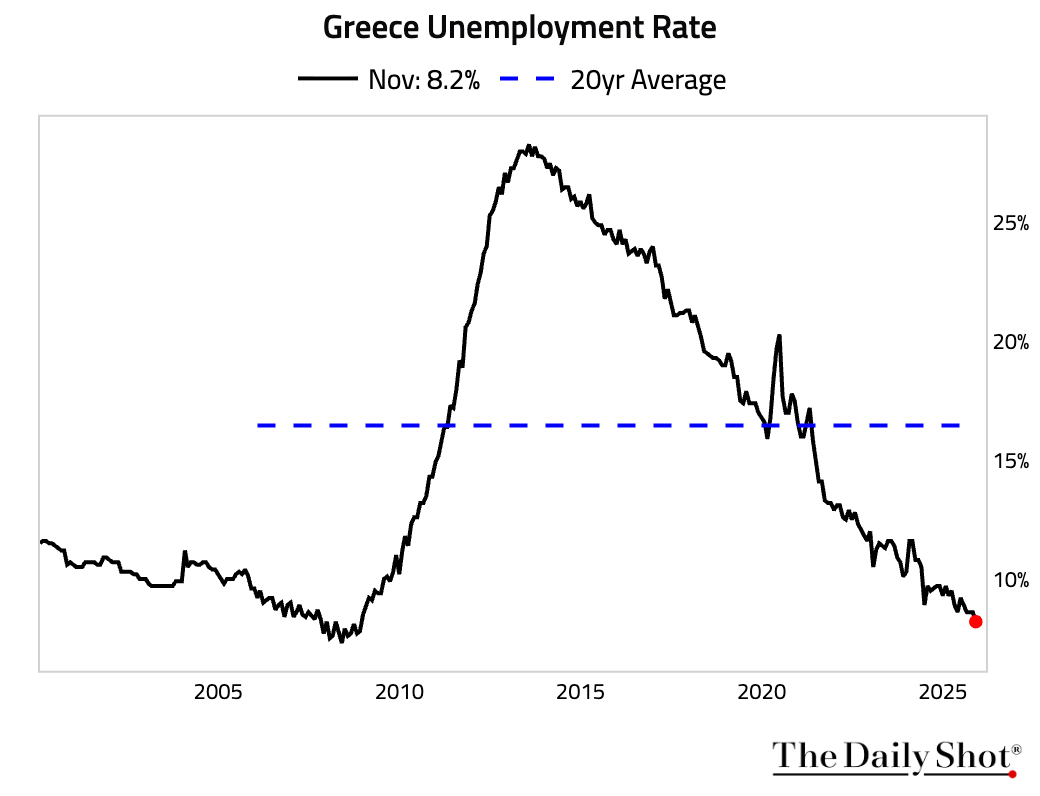

The unemployment rate fell to its lowest level since November 2008.

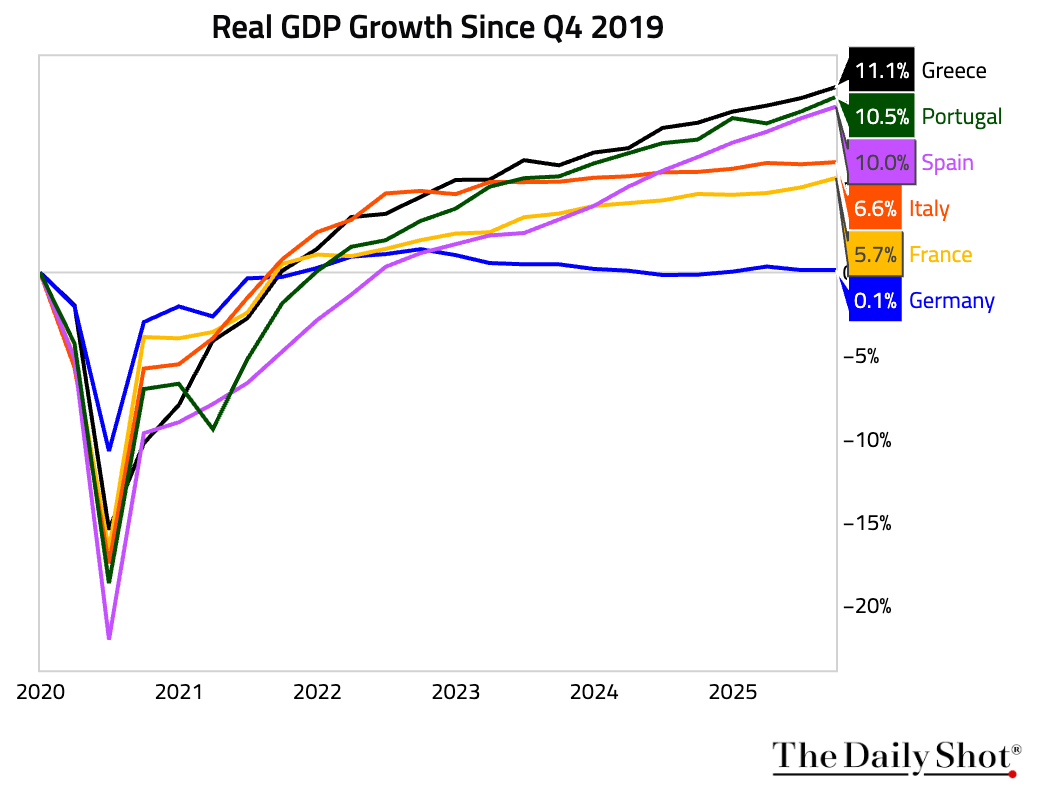

The Greek economy has outperformed peers since Q4 2019.

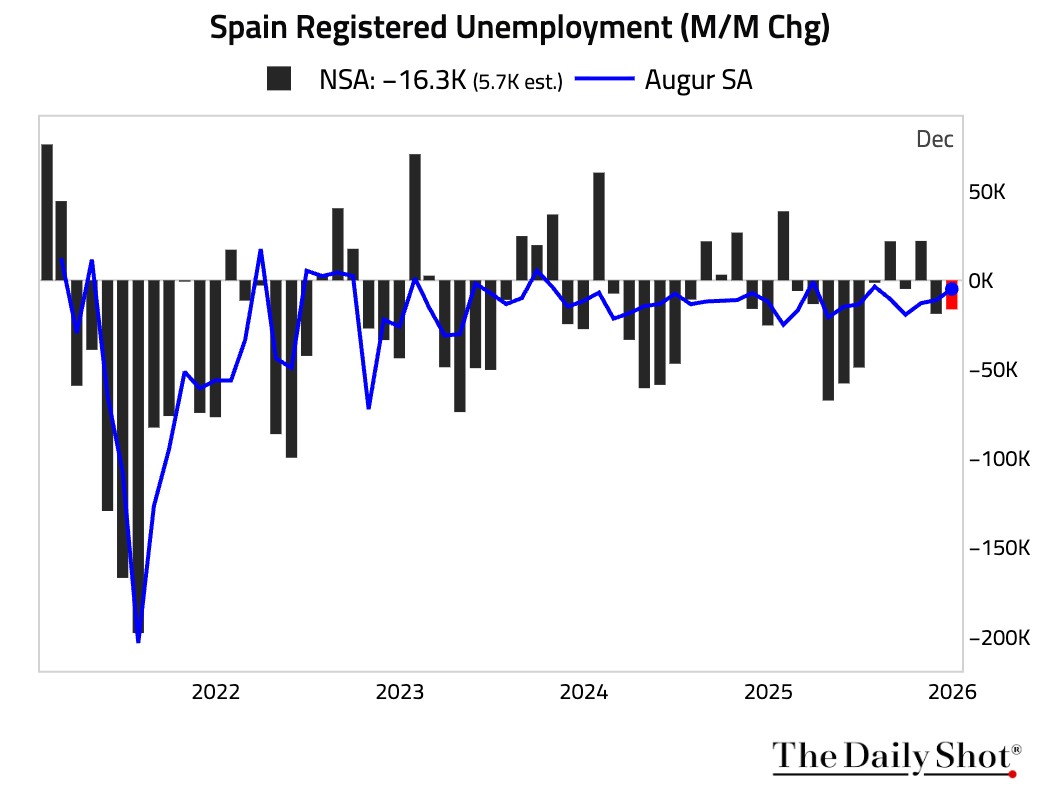

4. Spain registered an unexpected decline in unemployment for December.

Japan

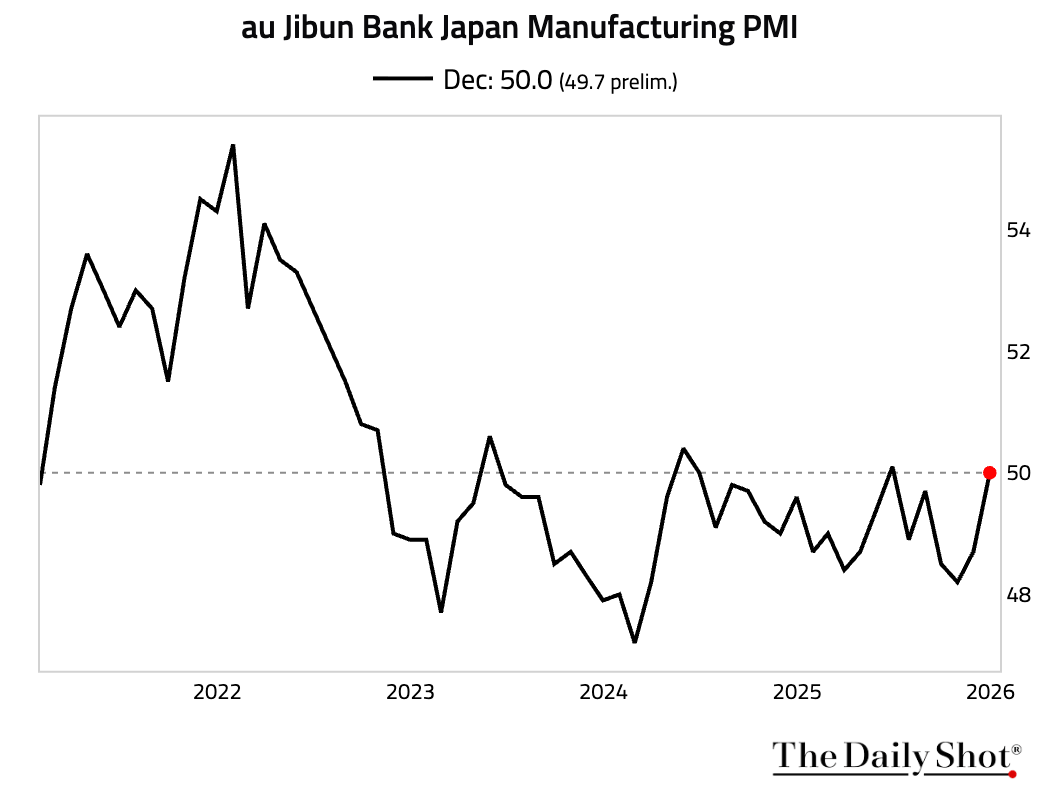

1. The manufacturing PMI was revised up to 50, ending a five-month contraction.

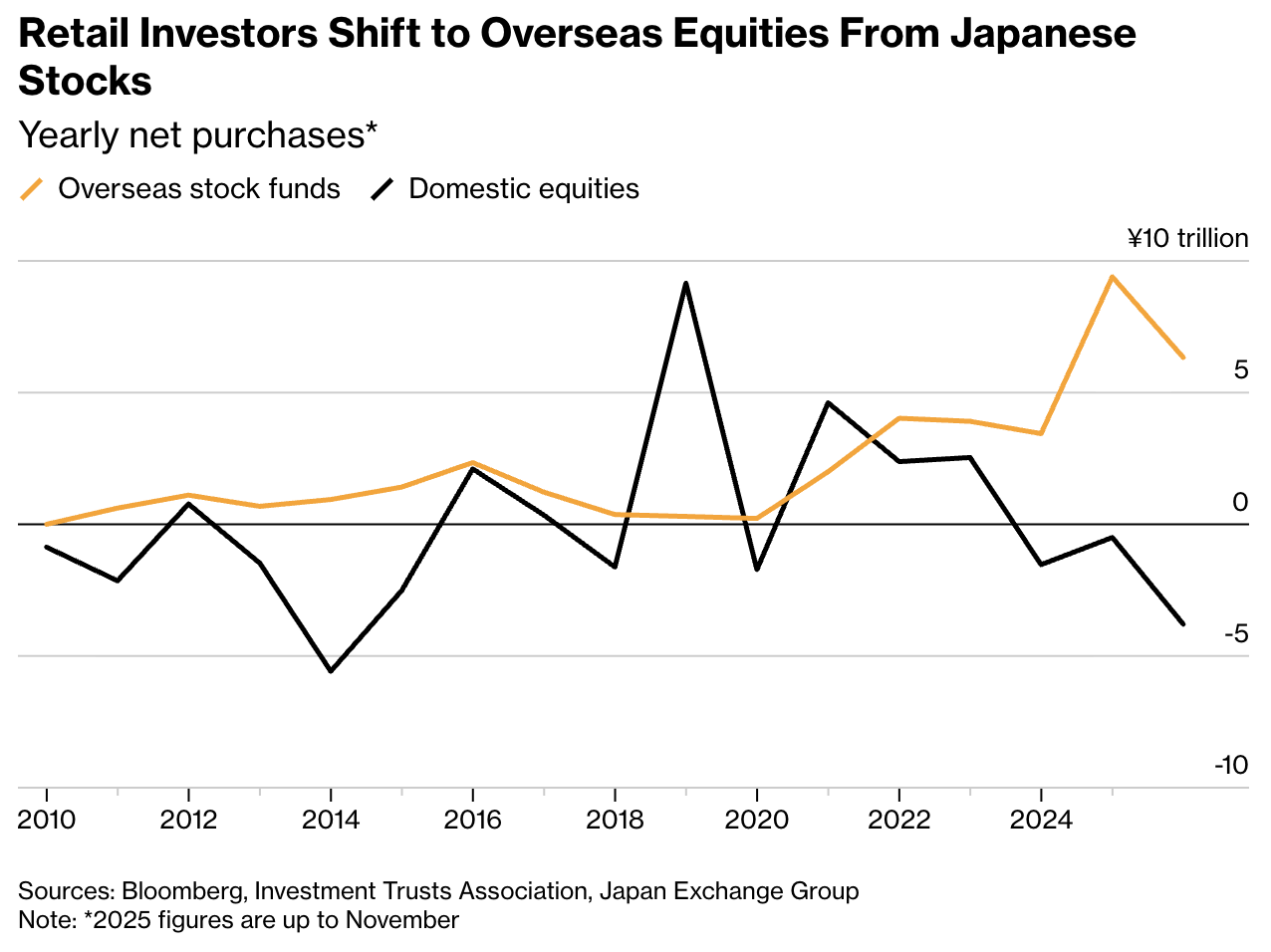

2. Retail investors continue to shift capital overseas, especially into US equities.

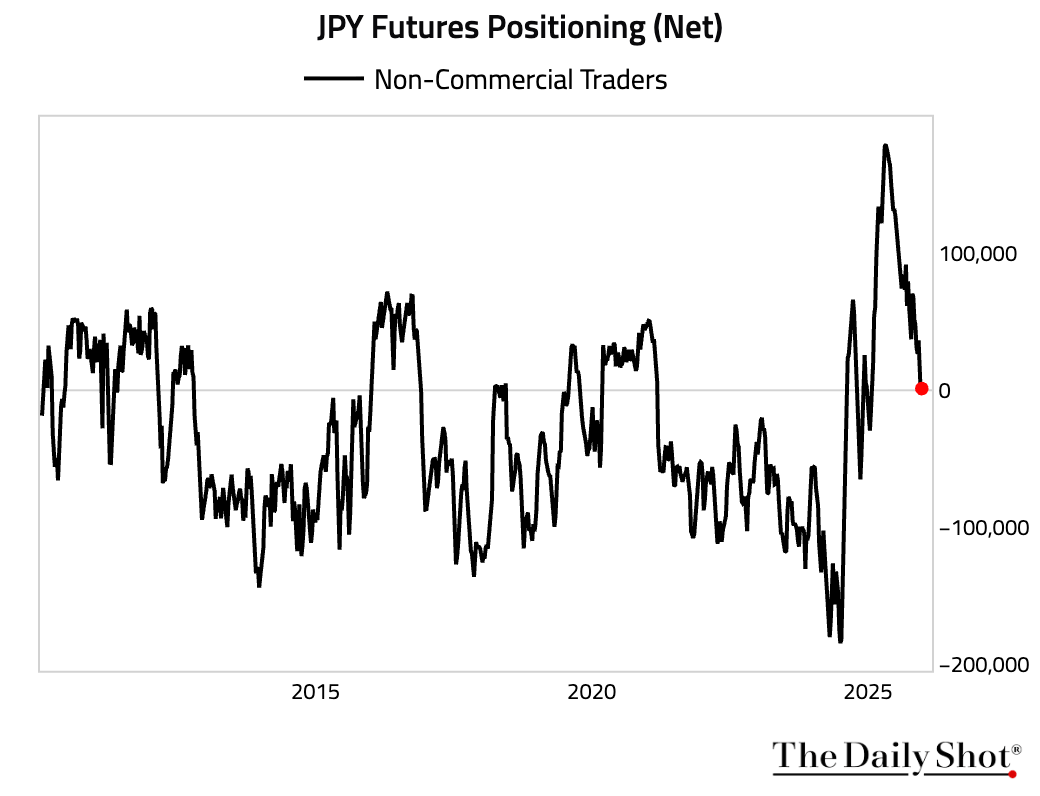

3. Net positioning of non-commercial traders in the yen is now roughly flat.

Asia-Pacific

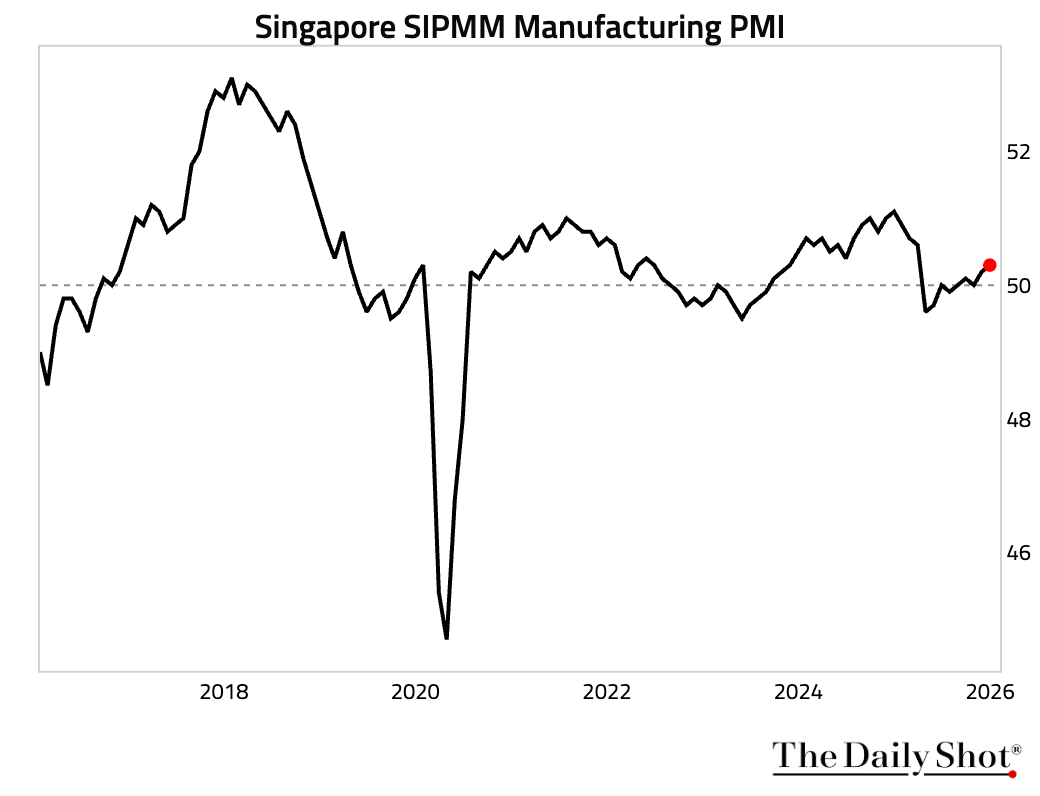

Singapore’s manufacturing PMI edged further into expansionary territory.

China

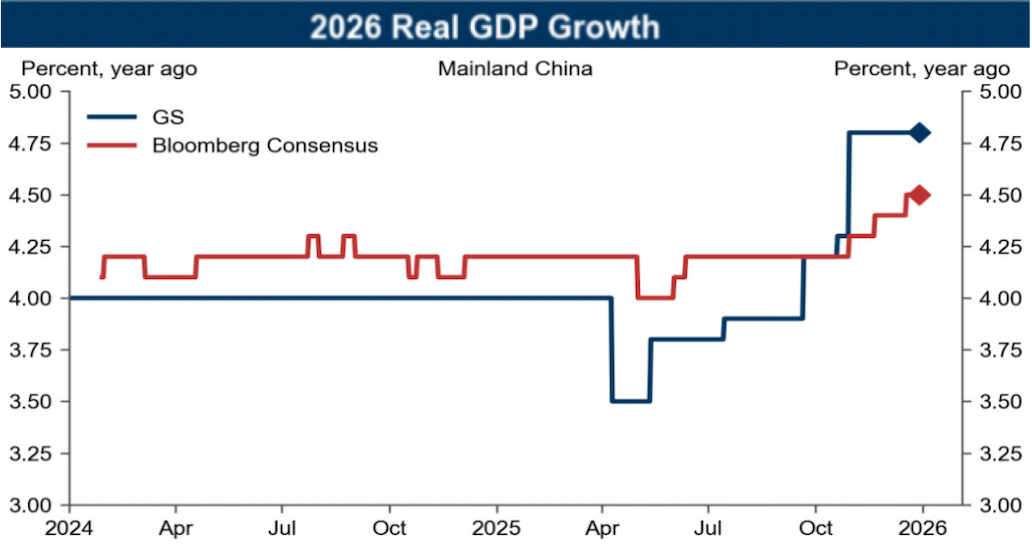

1. Consensus and Goldman Sachs GDP growth forecasts for 2026.

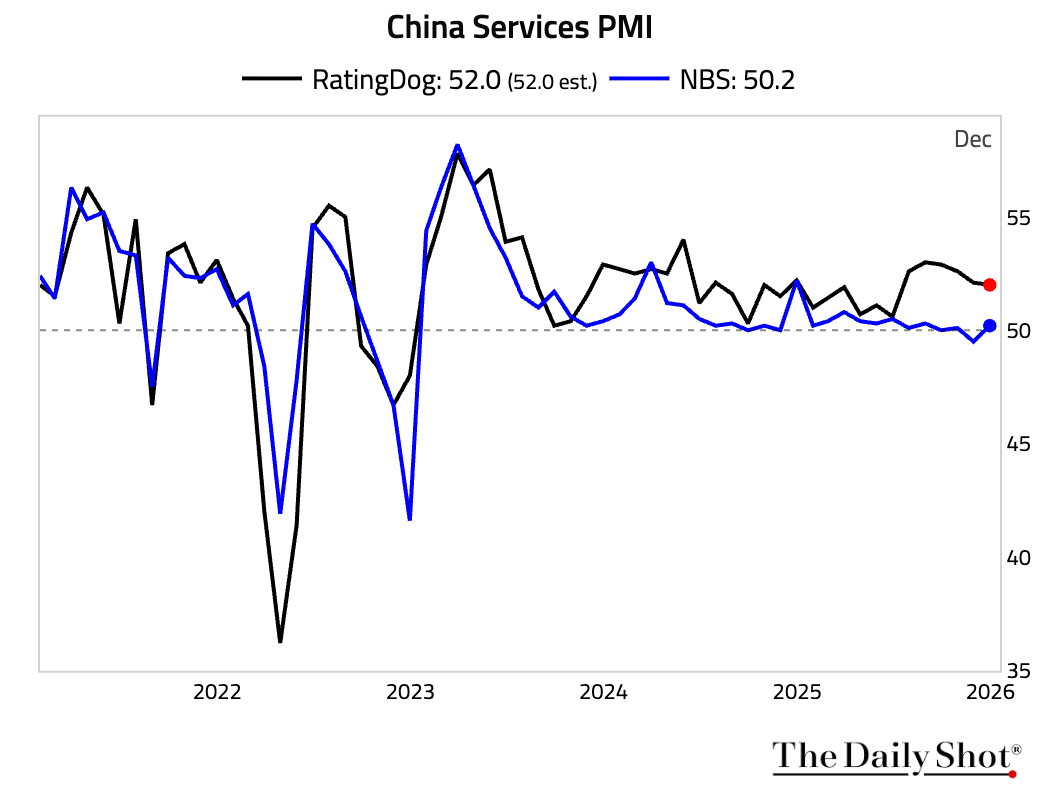

2. The RatingDog (formerly Caixin) Services PMI softened but remained firmly expansionary.

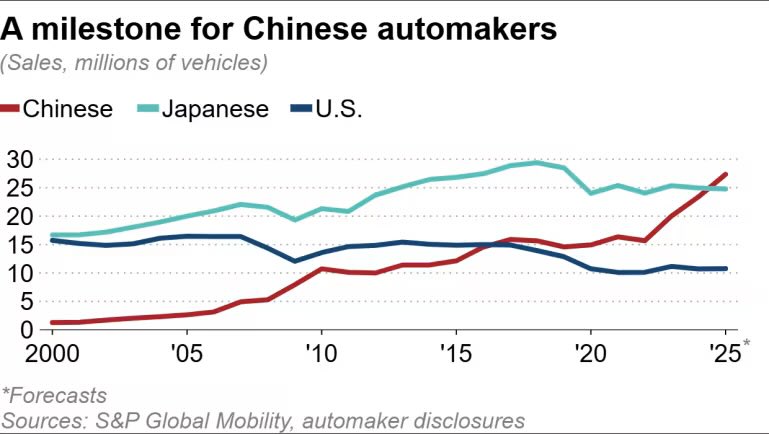

3. Chinese automakers are set to become the world’s top sellers in 2025.

Emerging Markets

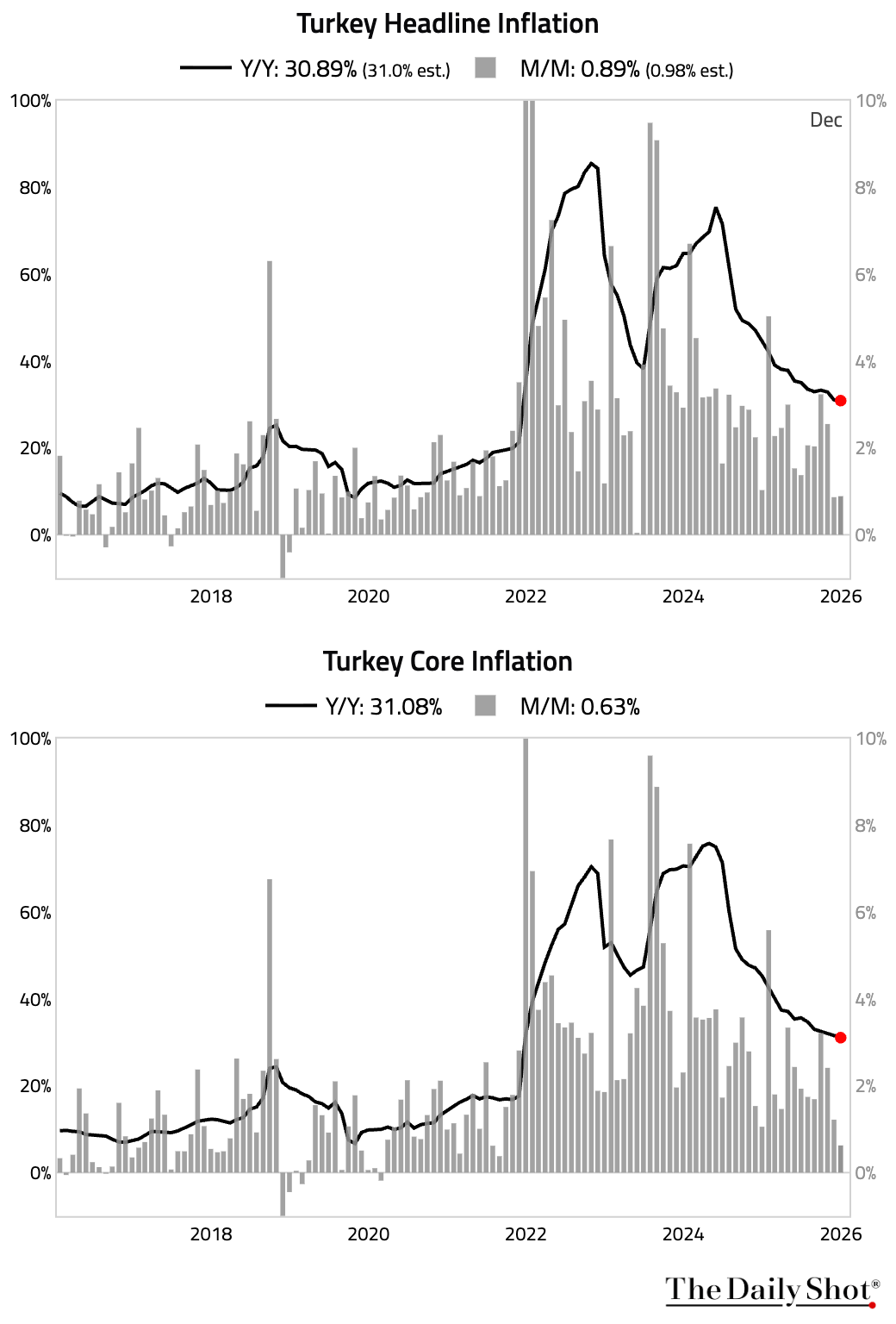

1. Turkey’s inflation eased in December.

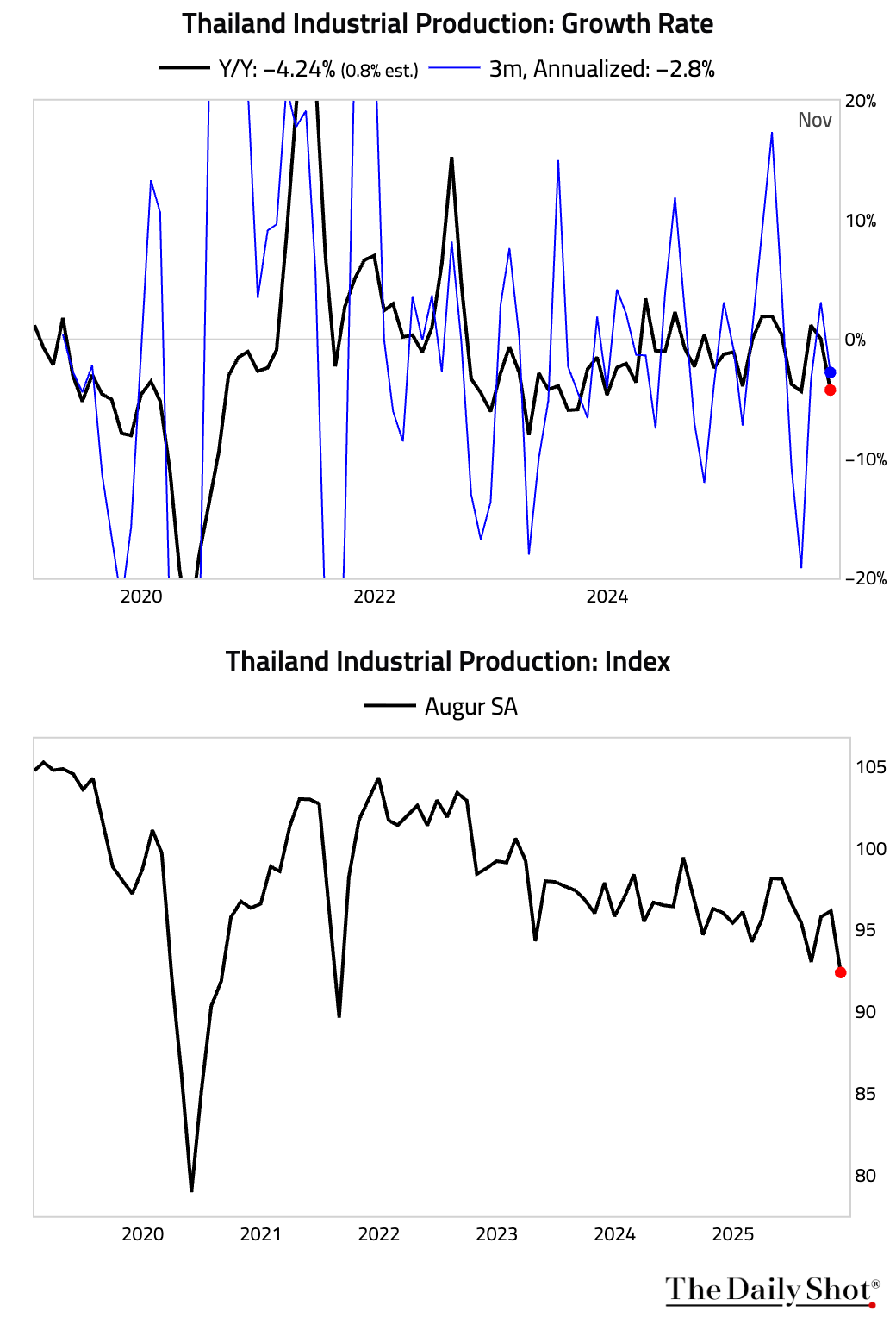

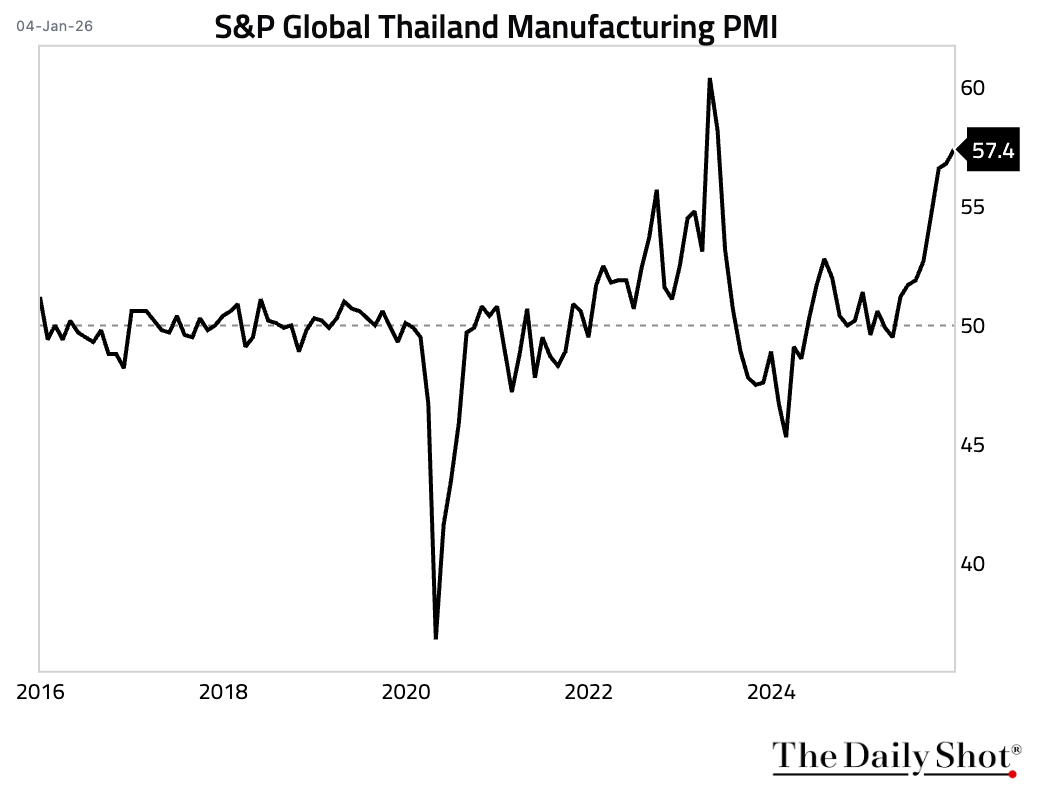

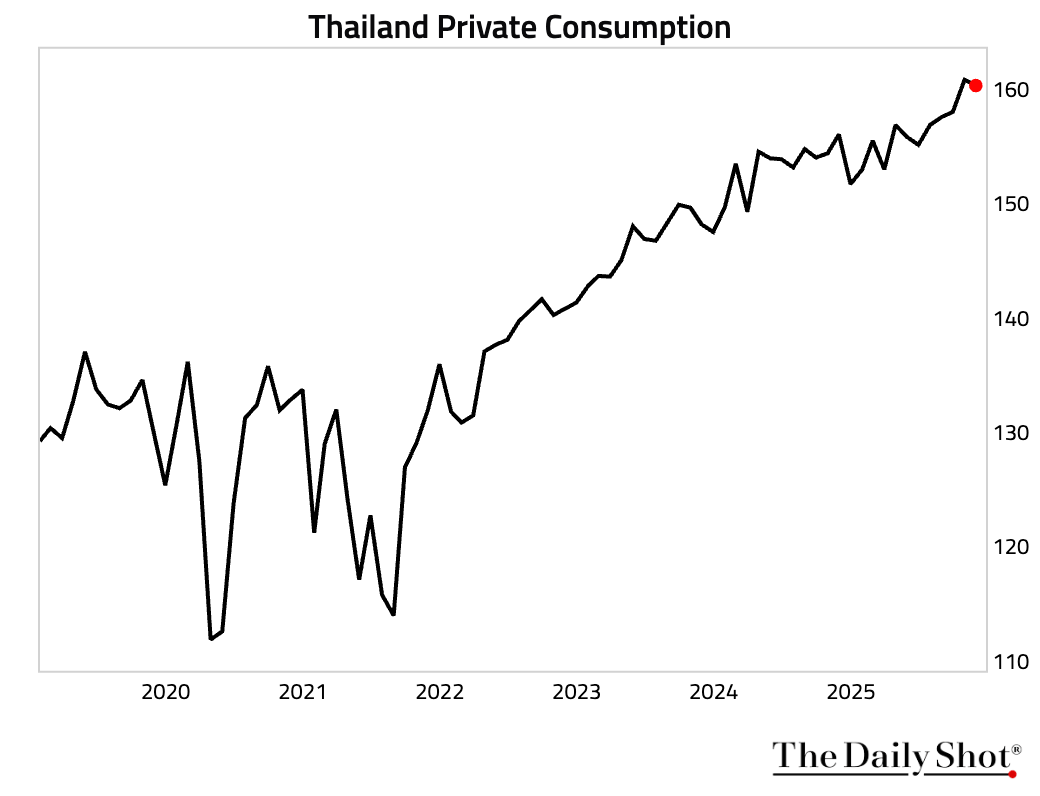

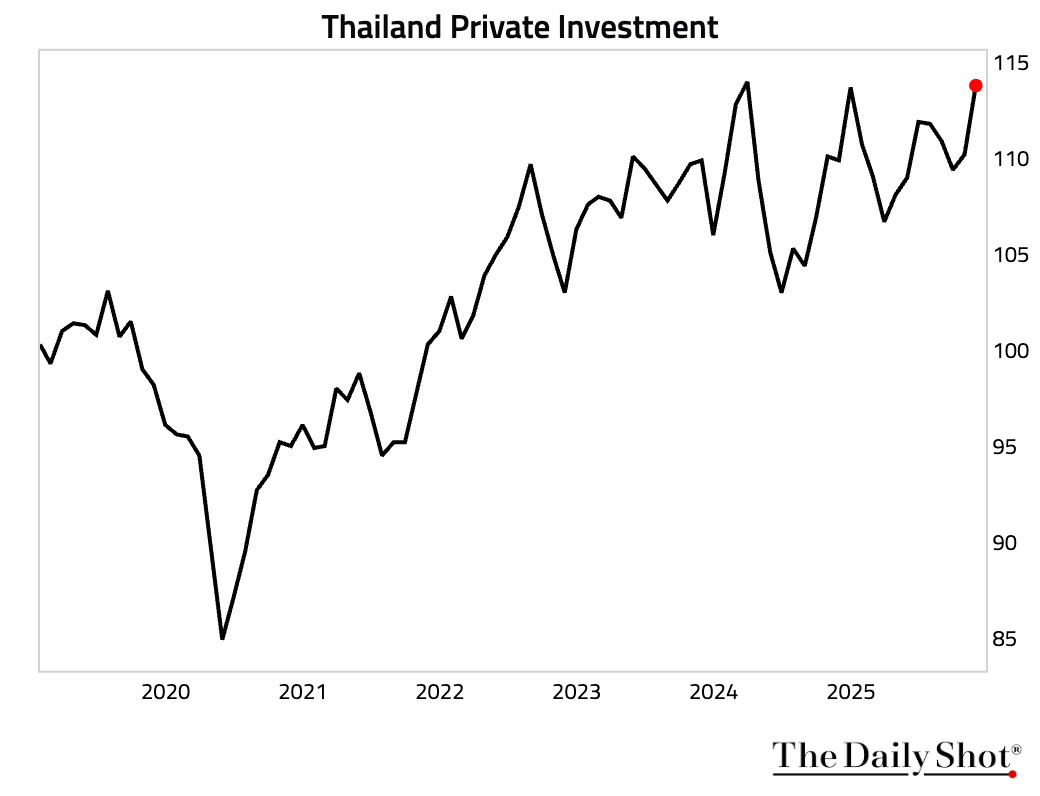

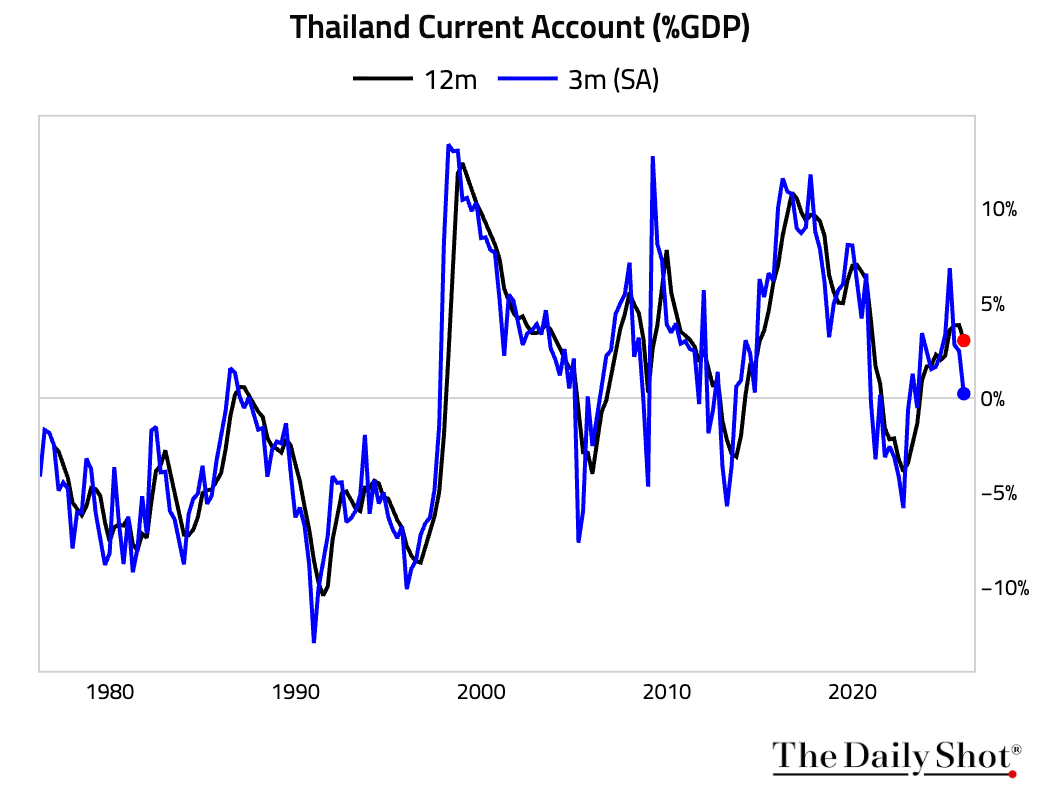

2. Thailand updates:

– Industrial production contracted.

– PMI surged on domestic demand.

– Private consumption weakened, investment rebounded.

– Current account deteriorated.

Equities

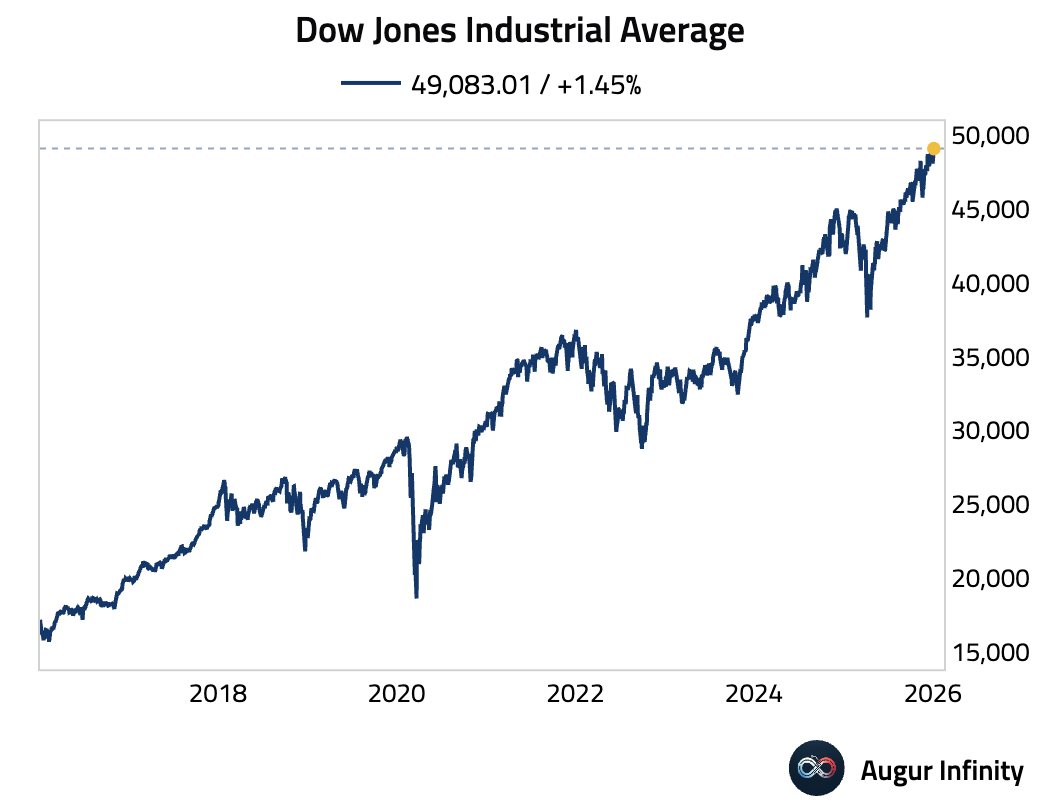

Equity markets started the year strong, with the Dow Jones Industrial Average reaching an all-time high.

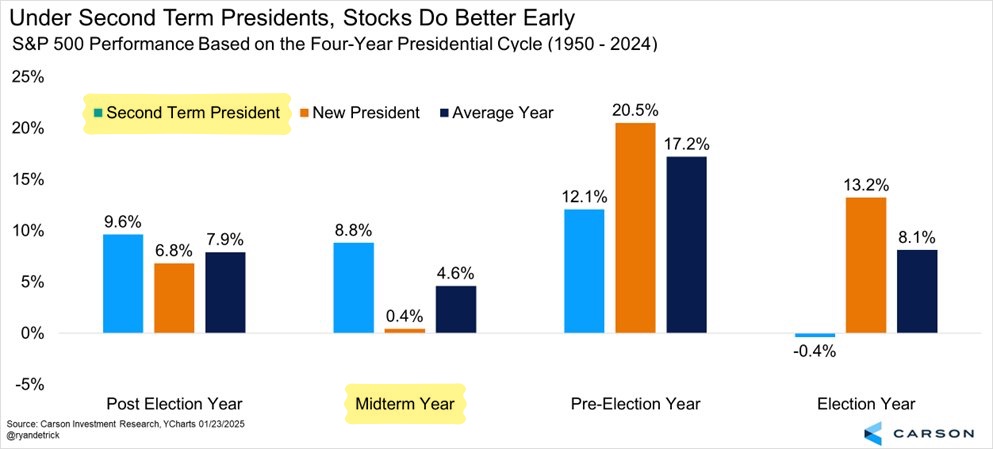

Historically, equities tend to be weak in midterm years, and 2026 is a midterm year. That being said, stocks tend to fare better during midterm years under second-term presidents.

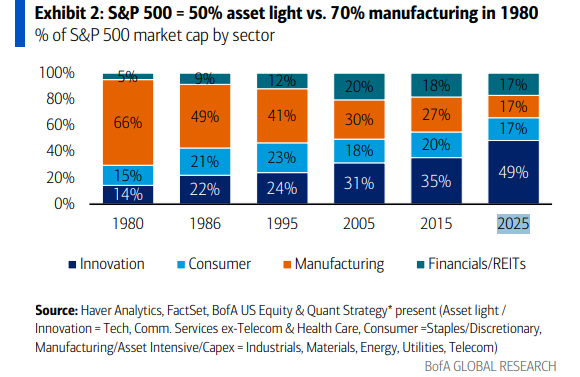

“Asset-light” companies have grown to account for 50% of the S&P 500.

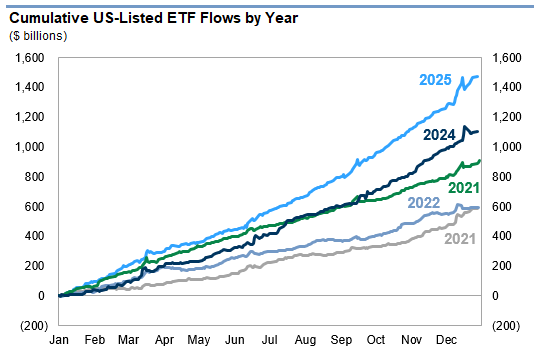

The US ETF industry added over $3 trillion in market value in 2025, its largest nominal year-over-year gain ever, reaching $13.4 trillion in assets under management.

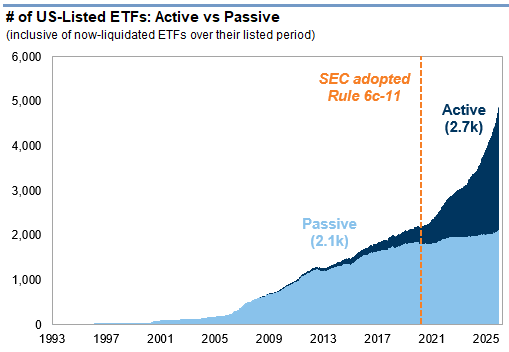

• For the first time ever, the US ETF market saw the total number of actively managed ETFs overtake their passive counterparts.

Rates

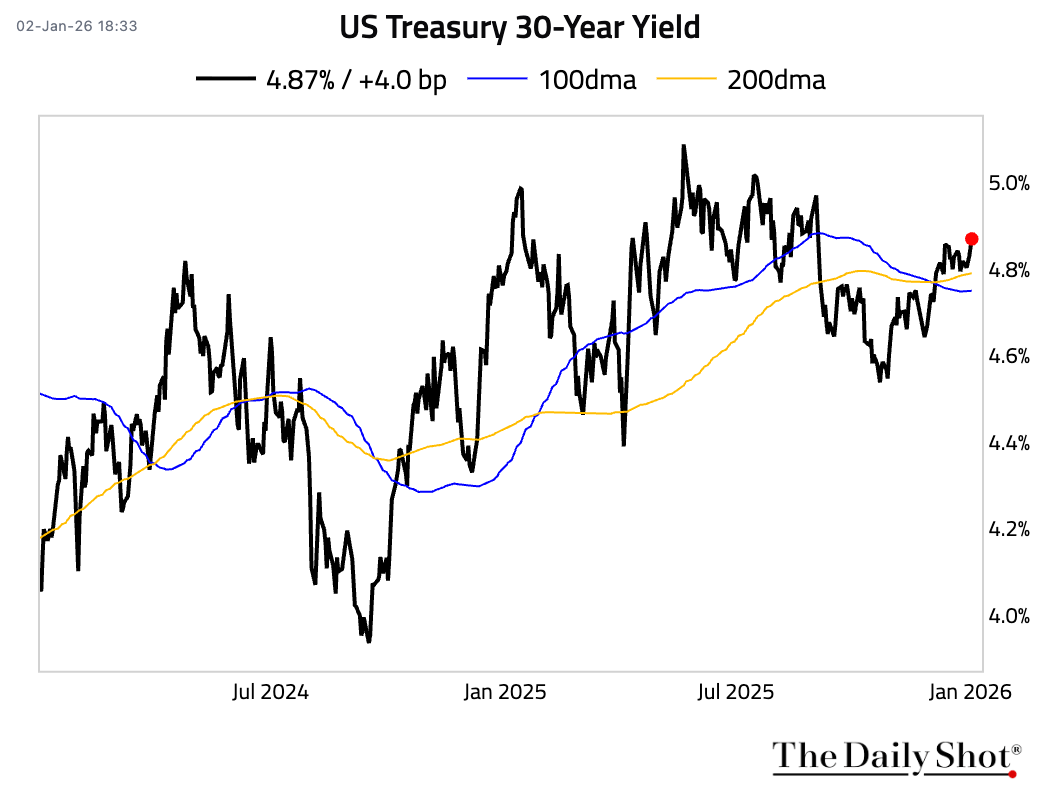

1.1The 30-year yield has risen to the highest level since last September.

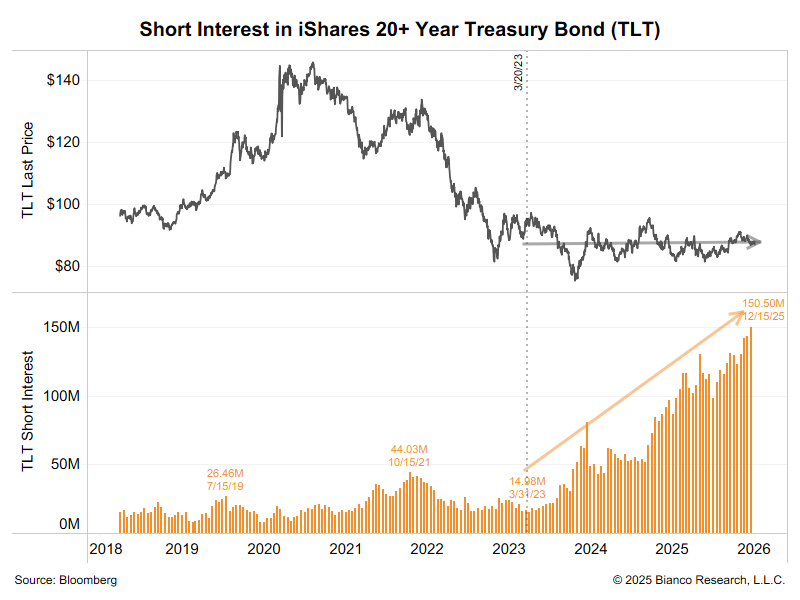

2.2Short interest in TLT, the 20+ year Treasury Bond ETF, has surged.

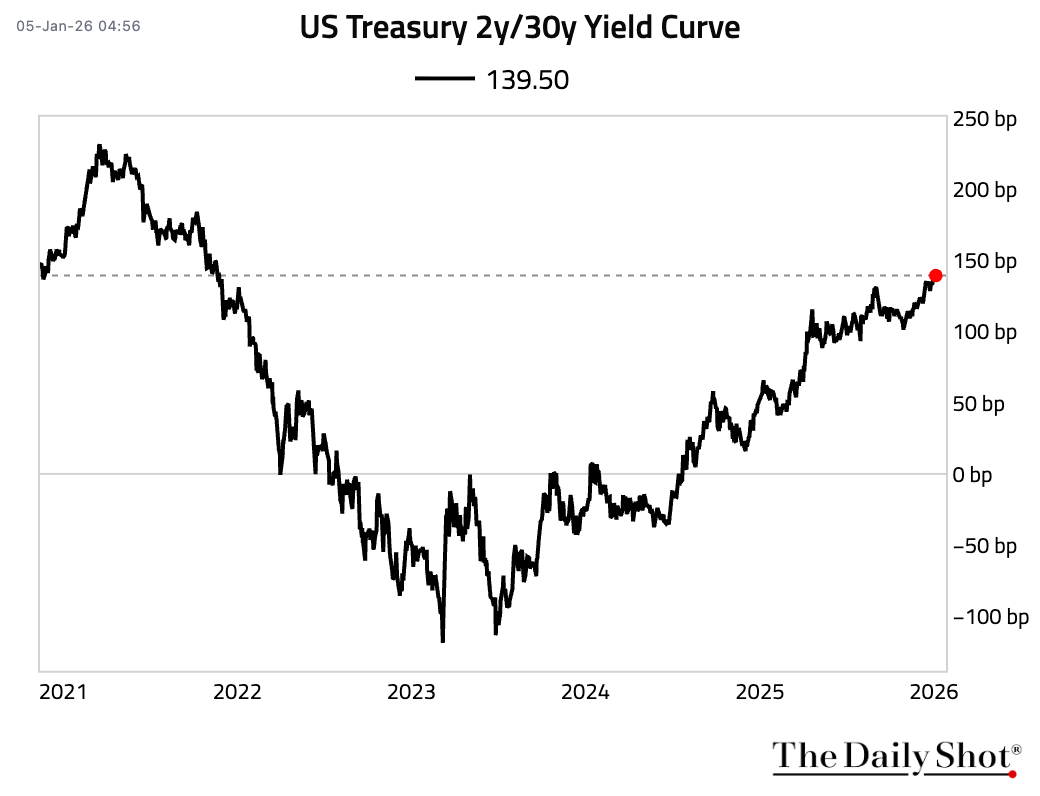

The yield curve continues to steepen, with the 2-year/30-year spread at its steepest level since November 2021.

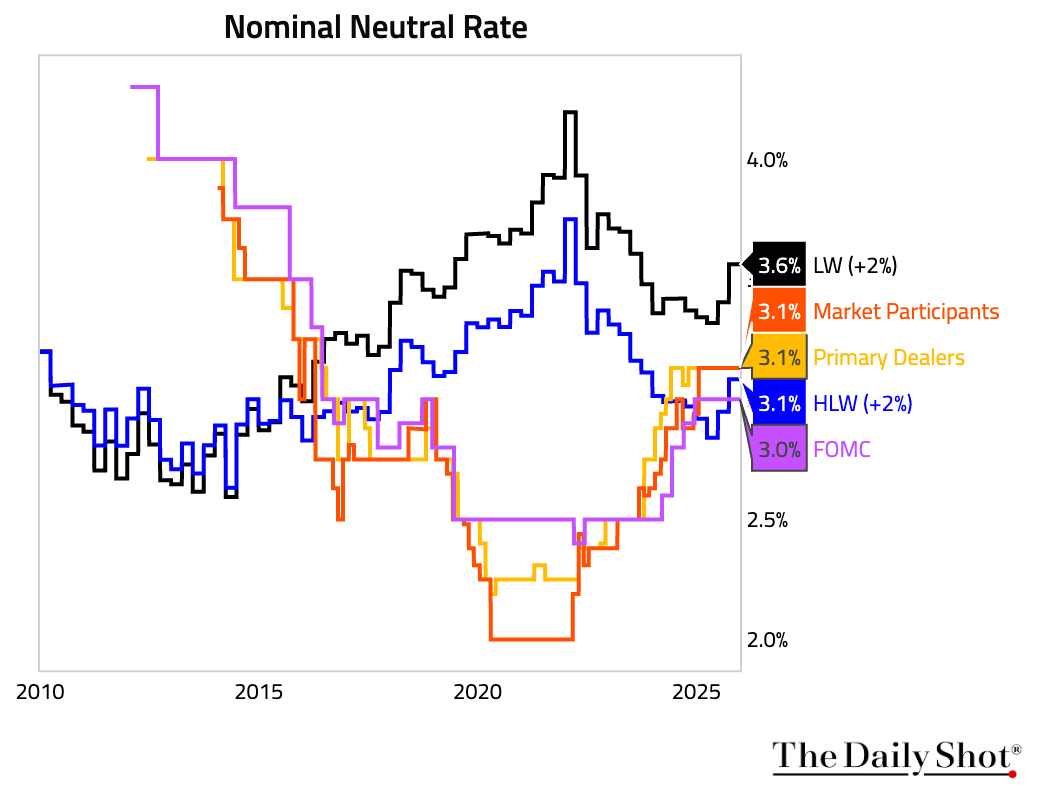

4Neutral rate estimates for the US are all above 3% in nominal terms.

Credit

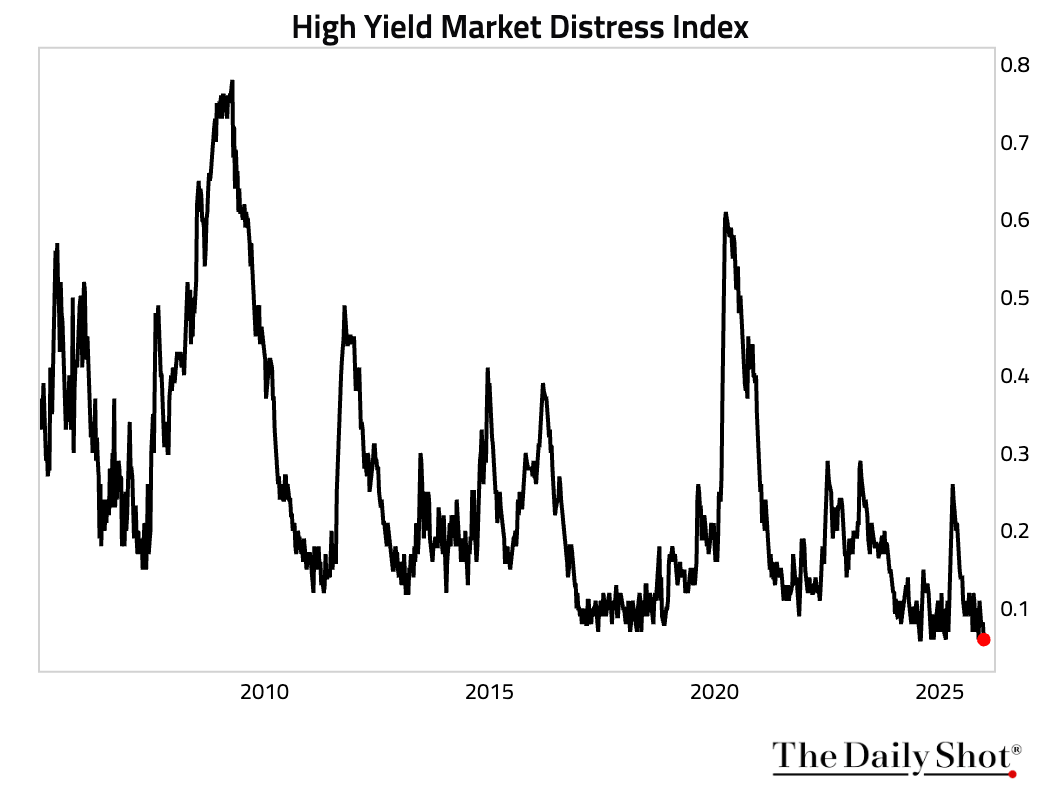

The New York Fed’s high-yield market distress index fell back to secularly low levels.

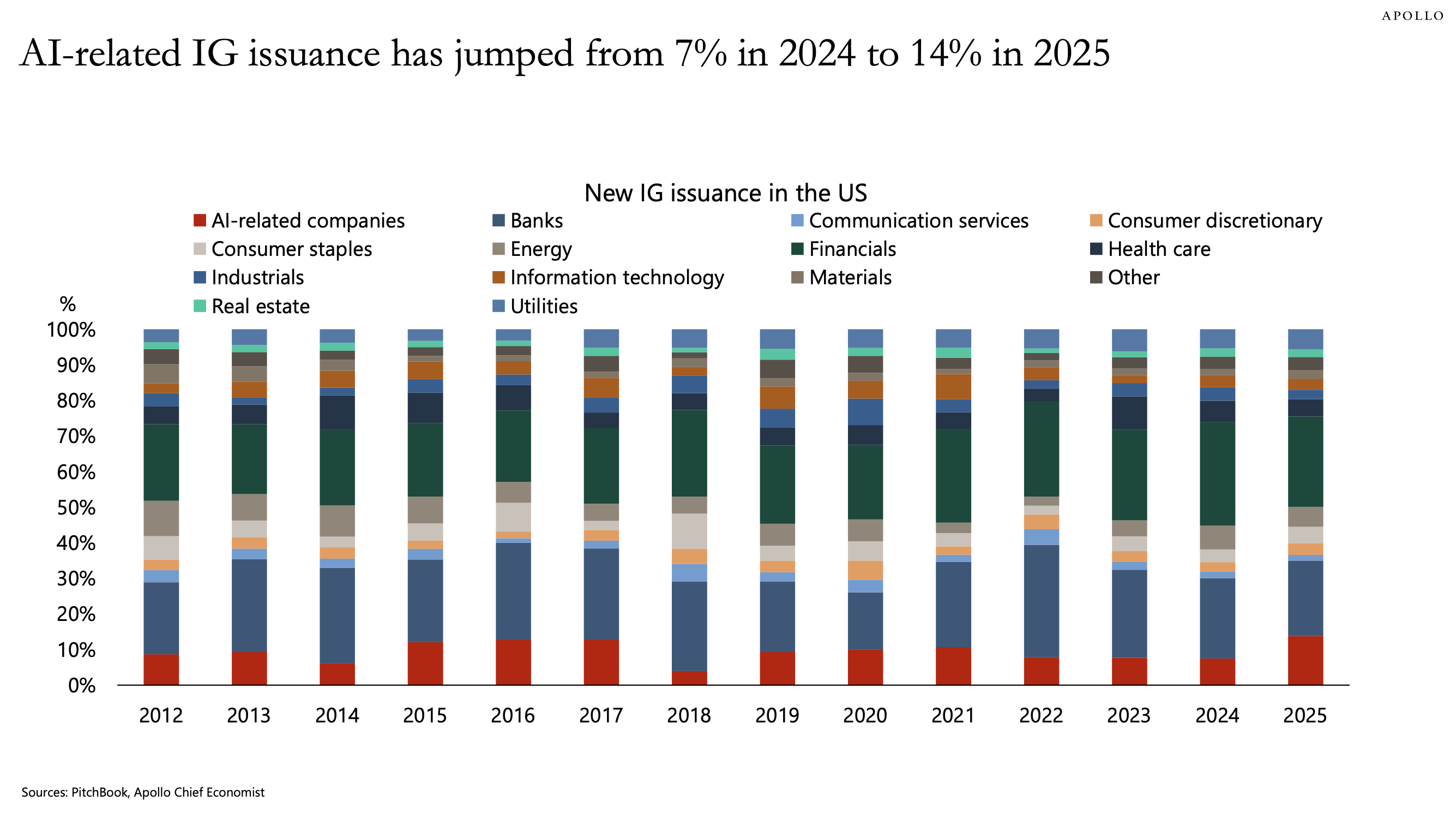

AI-related companies now represent an increasing share of investment-grade issuance.

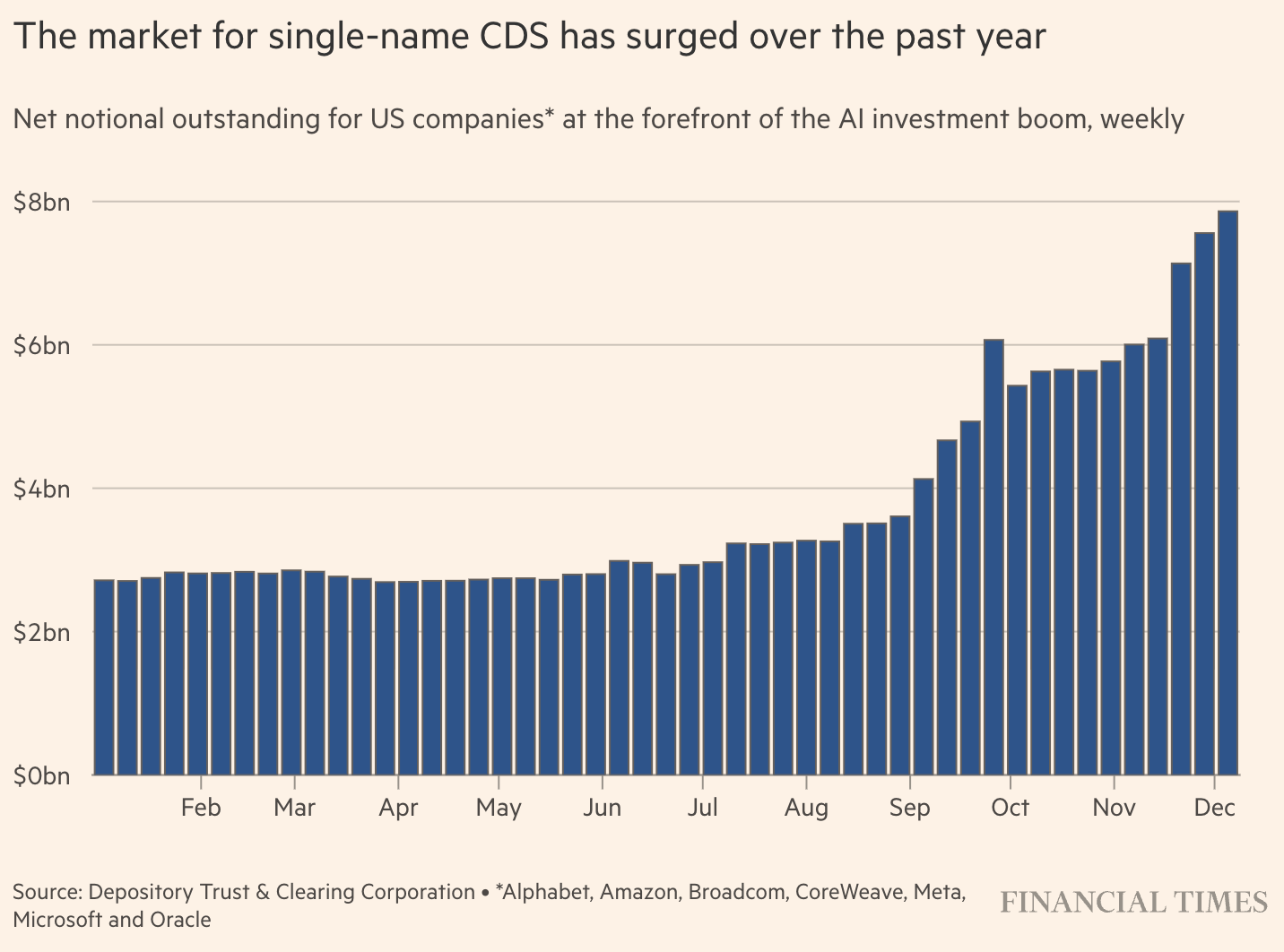

Investors are increasingly using credit default swaps to hedge against a potential AI-driven debt bust, as heavy borrowing by major tech firms to fund data centers and infrastructure raises concerns about future returns.

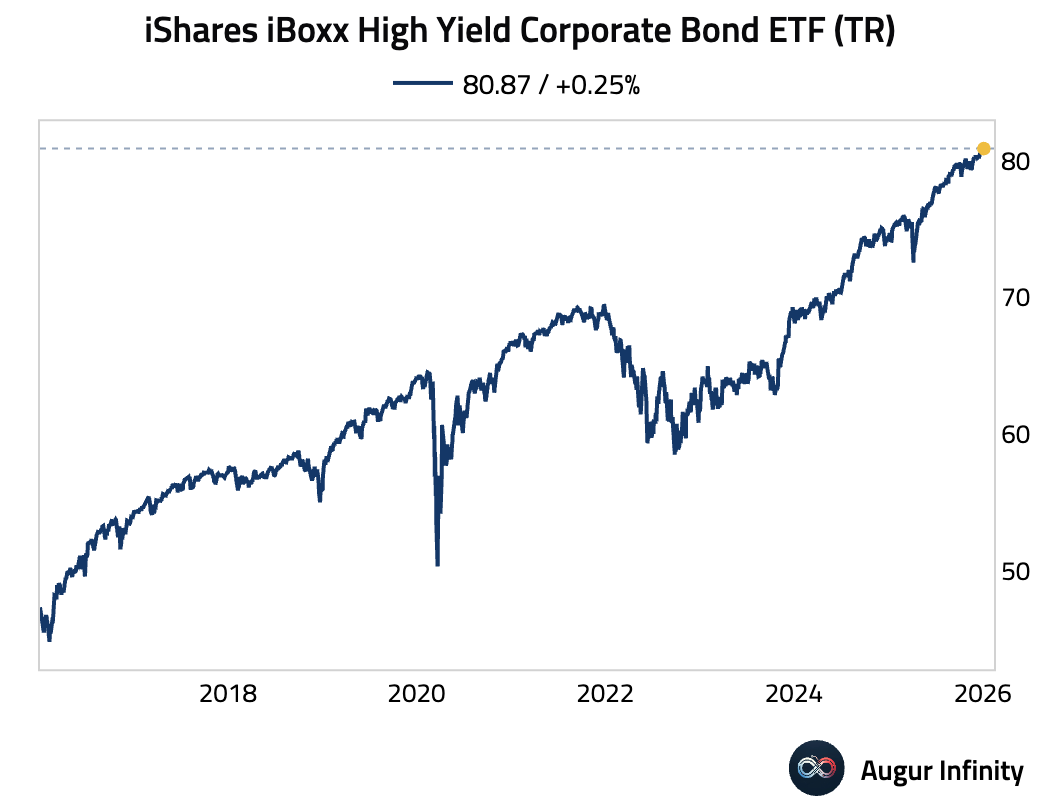

4 4. iShares iBoxx High Yield Corporate Bond ETF (TR) has reached an all-time high.

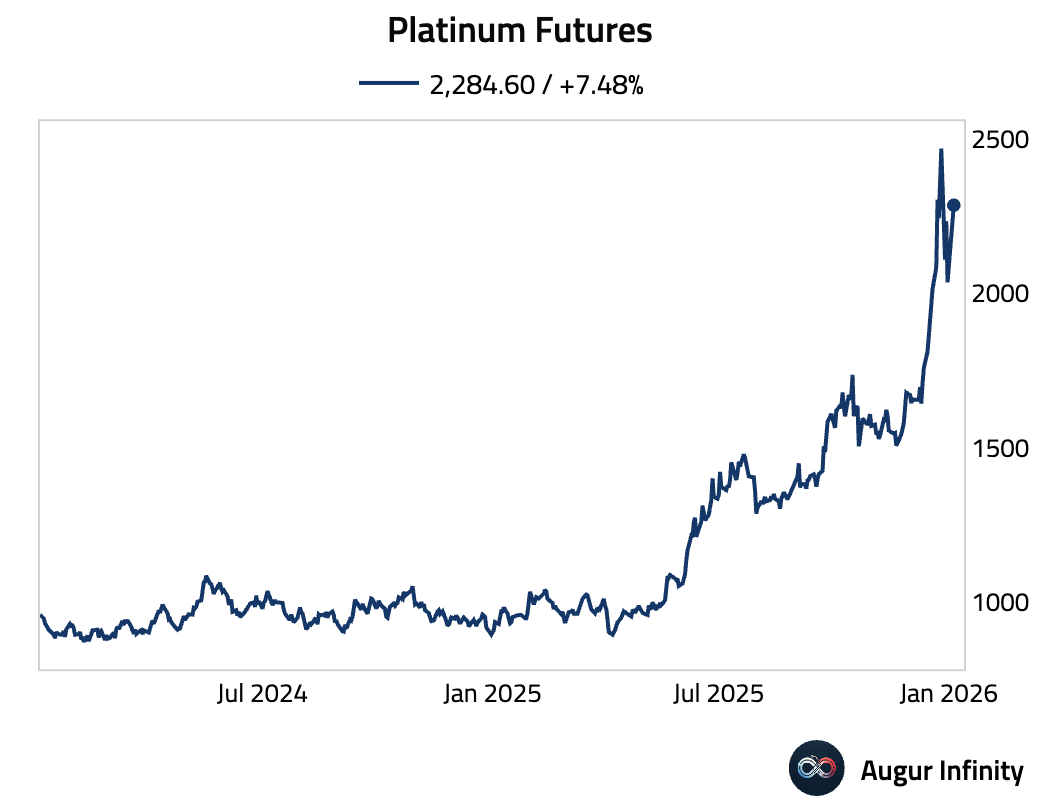

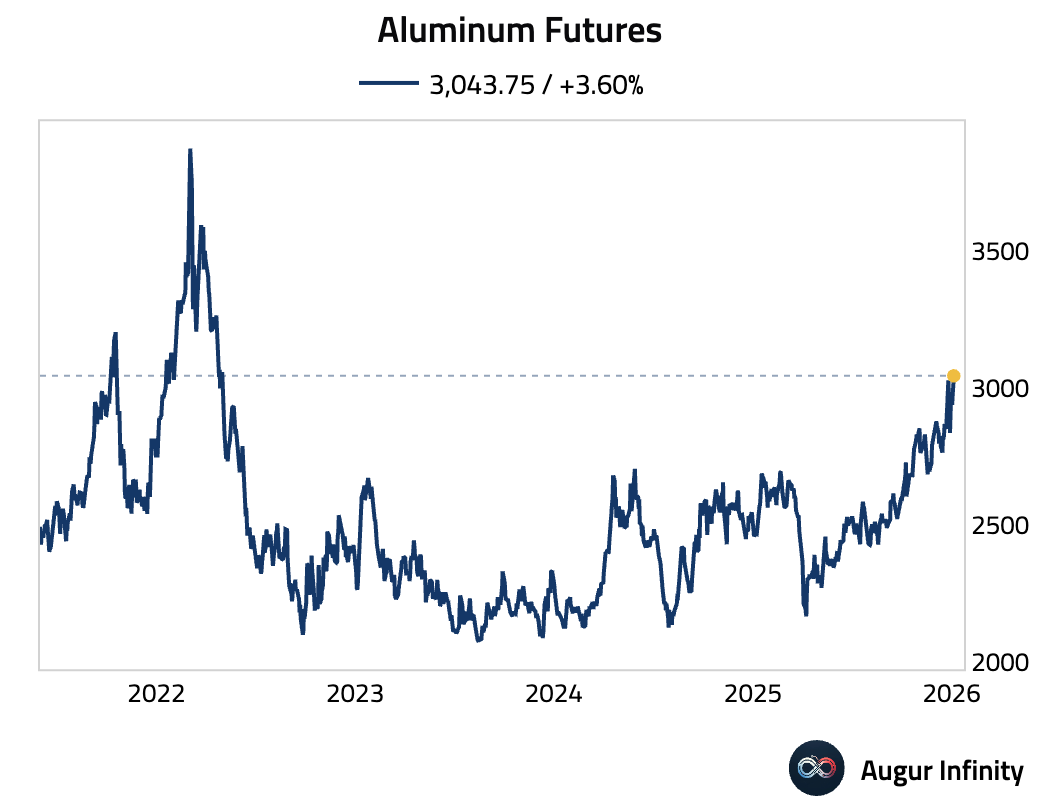

Commodities

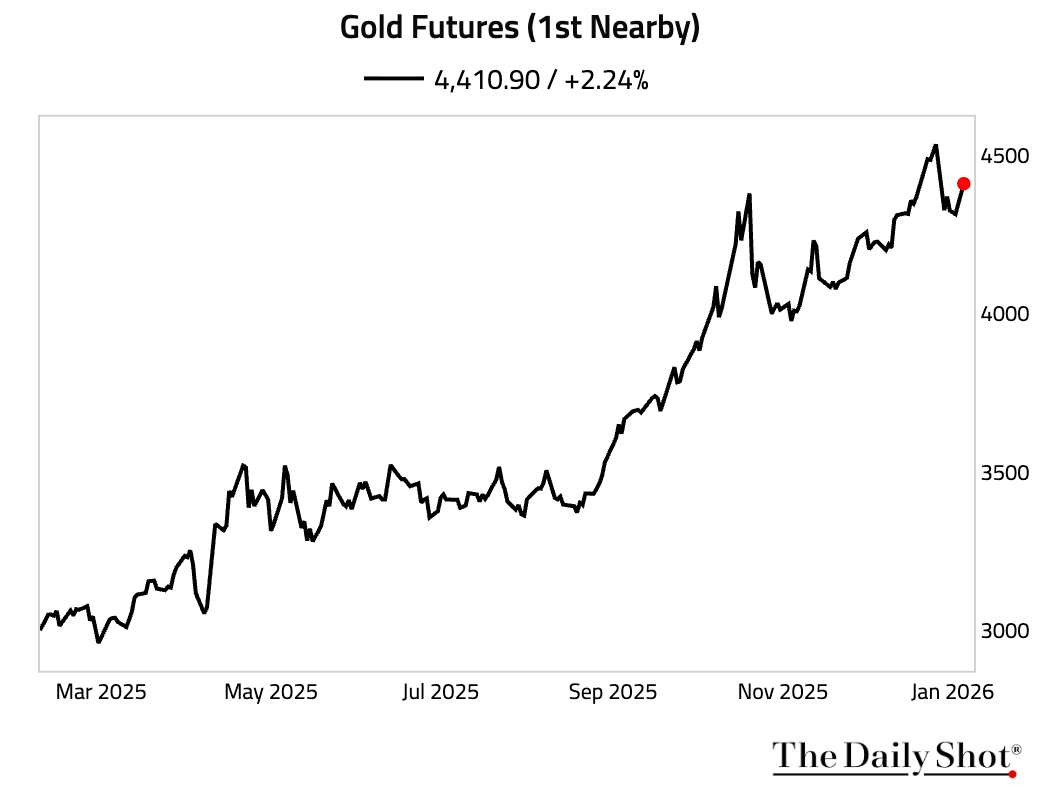

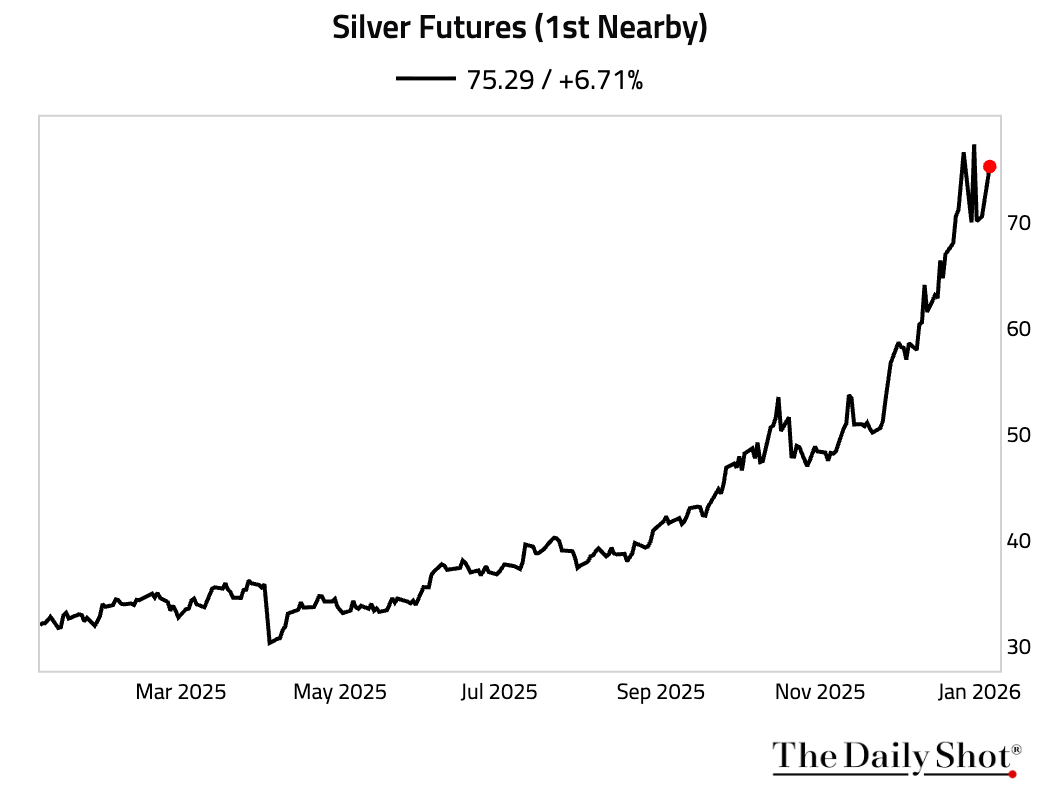

Gold and silver advanced, with investors seeking safe havens from geopolitical risk.

Platinum jumped in a 2.2σ move.

Aluminum futures are at the highest level since May 2022.

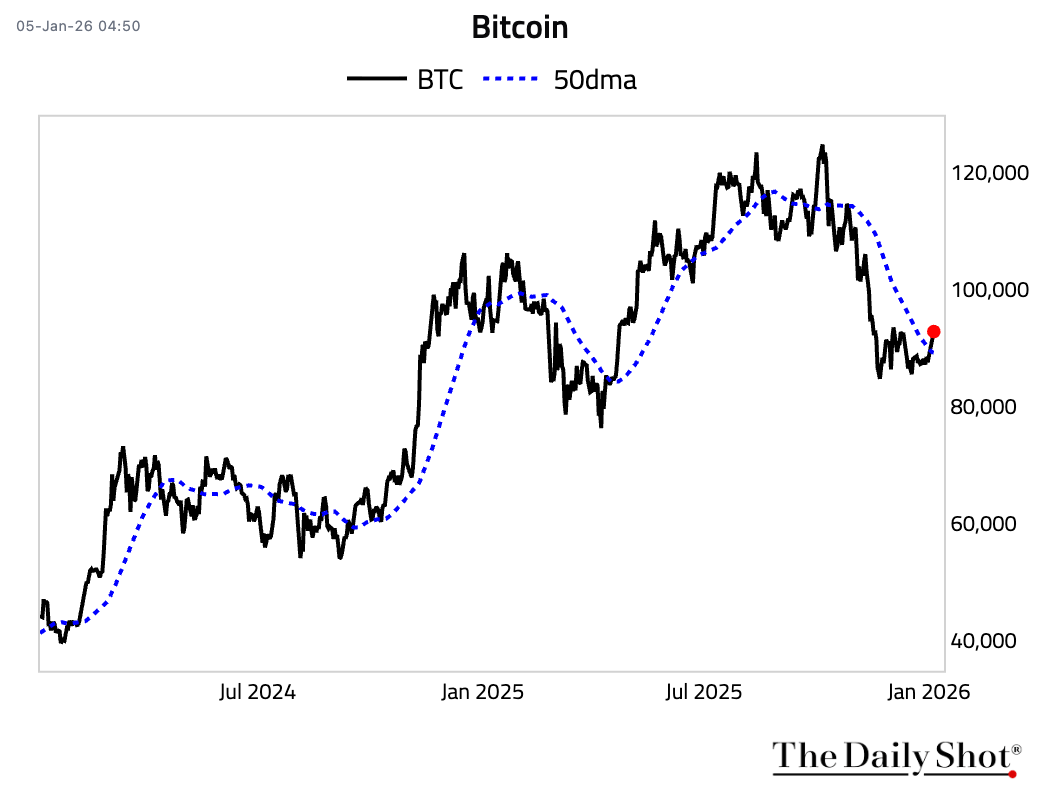

Cryptocurrency

1. Bitcoin is above its 50-day moving average.

Disclaimer

Augur Digest is an automatically generated newsletter edited by humans.

It may contain inaccuracies and is not investment advice. Augur Labs LLC will not accept liability for any loss or damage as a result of your reliance on the information contained in the newsletter.